The new Business Plan, which drives Hera’s roadmap to 2028, has all the features of a high visibility and low-risk growth plan.

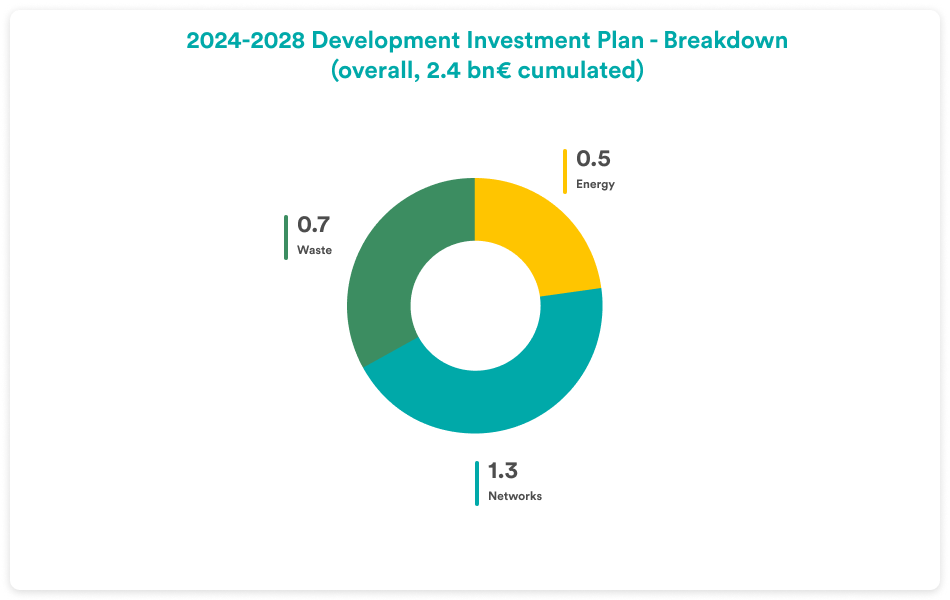

As much as 2.4 billion of the 4.6 billion in investments cumulatively planned over the five-year period are development investments – out of which 2.1 billion as operating capex and about 300 million for M&A. In addition, there are 500-million-euro investments funded through non-repayable grants.

Hera will dedicate around 60% of those development investments to Networks and Waste collection, thus providing high visibility to the 9.5% ROI target in 2028, compared to the 8.7% adjusted figure for 2023.

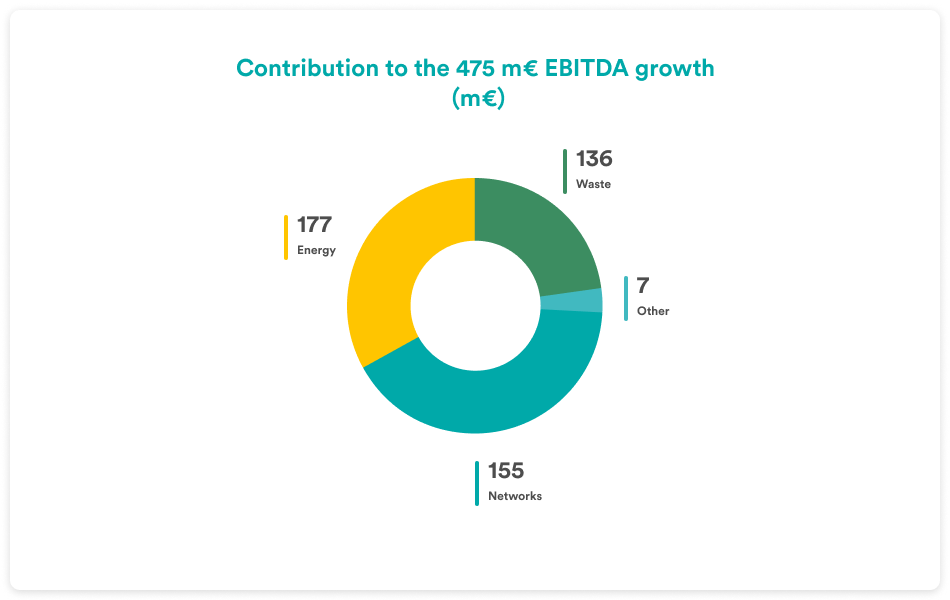

Boosted by planned investments, all businesses will make an improved contribution to Group EBITDA, which is expected to structurally increase by 475 million euro over the five-year period, leveraging on specific growth drivers, differentiated by area.

Due to a thorough capital allocation within its portfolio, Hera will count on a balanced asset breakdown at the end of the Plan: a factor that underpins the resilience of the Group’s financial results even when high volatility affects the scenario variables.

| 2024-2028 BUSINESS PLAN |

CUMULATIVE INVESTMENTS 2024-2028 bn€ 4.6 |

2028 EBITDA m€ 1,700 |

2028 ROI 9.5% |

2028 LEVERAGE (Debt/EBITDA) 2.8x |

A total of 4.6-billion-euro investments, with a substantial weight of the development component, will be wisely distributed across the various businesses – this is how Hera builds the foundation for continued growth, high returns, and resilient results.

Hera has planned to invest 4.6 billion euro over the 2024-2028 five-year period. A significant component of this amount, equal to 2.1 billion euro, will be dedicated to development projects in the form of capex, while M&A transactions, another growth catalyst, will absorb around 300 million euro.

Development investments will be allocated to reflect the needs and return opportunities offered by individual business areas, benefiting from a multi-business set-up. This way, capital allocation follows a logic of portfolio optimisation, which allows the best return opportunities to be seized on the different market segments at a specific time, and to achieve Group-wide results that minimise the impacts of volatility in the external environment.

Over the five-year Plan period, the group will devote about 60% of development investments to regulated businesses, when considering, in addition to Networks, those waste-collection activities that are part of the Waste area.

All strategic areas will contribute to improve Group EBITDA

In 2028 Hera expects to achieve a 1,700-million-euro EBITDA, with a structural improvement of 475 million compared to the 2023 adjusted data. All businesses will contribute to the achievement of this progress, with well-balanced weights: in the expected figure for 2028, 36% of EBITDA is attributable to Networks, 28% to Waste and 34% to Energy.

The EBITDA of the different strategic areas reflects specific factors fuelling growth

In the Networks, Hera will leverage on a strong plan of development capex and M&A, for a total amount of 1.3 billion, as well as on achievable efficiencies in the management of its asset that are rewarded by the regulation. Over the Plan period, key operational metrics include a 10% reduction in network losses, which is also the result of the application of new technologies that facilitate predictive maintenance, and a 14.4% increase in reused water. In addition to an expansion in district heating, an increase in the number of connections is expected. Another not negligible factor: the full consolidation of AIMAG activities, which in 2028 should reach 77 million euro of EBITDA, will make a significant contribution to the overall 155 million increase in EBITDA of the Networks area.

Hera will also dedicate significant investments to a strengthening of its network infrastructure to make it increasingly resilient to high-impact weather events, which Climate Change is making more frequent. Finally, in the context of decarbonisation, investments will make Hera’s networks ready to distribute hydrogen.

Due to the planned investments, RAB of gas and electricity distribution and water cycle activities is expected to increase from 3.3 billion euro in 2023 to 4.5 billion at the end of the Plan, with growth nearly double that of the FCF generated by Network activities; a choice that allows for portfolio rebalancing, supported by increased profitability, considering the reviewed WACC.

Through planned investments, part of which have already been implemented as in the case of the AIMAG deal, and careful operational management to take full advantage of the remunerative structure of the regulatory framework, Networks’ EBITDA is expected to increase at a weighted average annual rate of 6%.

In the Waste area Hera will aim to expand the competitive advantages already achieved given the strong position enjoyed, by leveraging the offer of Global Waste Management solutions dedicated to business customers, who require a 360-degree service, and the ability to treat waste through circular economy models in highly specialised segments, such as high quality plastics (PE, PET and, in the future, carbon fibres and rigid plastics), which allow more remunerative pricing.

Hera will also seize the opportunities for returns that emerge from the partnerships it has signed to address the expansion both of markets and demand, which exceeds the capacity for plant development.

The five-year FCF of 900 million euro will be fully reinvested in development, to increase plant capacity and to carry out M&A transactions – selecting from more than 200 possible targets identified in the industry.

As a result of these actions, planned investments, including via M&A, and reinvestment of all cash flow generated by the business, EBITDA in the Waste area is expected to grow at a weighted average annual rate of 7% over the 2024-2028 period.

Lastly, in the Energy area, Hera will leverage its position as the third-largest operator in the Italian market, backed by a base of 4.5 million customers who have demonstrated a loyalty above the industry average, with a very low payment default rate. Therefore, Hera has all the premises to benefit from the ongoing liberalisation process, both because it has brought in nearly one million STG customers who will switch to a free-market contract with Hera itself automatically on April 1, 2027, and because organic development will substantially offset the physiological churn rate, consolidating in 2028 a customer base of 4.5 million units.

The Energy development investment, amounting to a total of 500 million euro, will be dedicated to support further expansion of the customer base, while applying very conservative assumptions in terms of churn rate. On the capex profile, Hera also planned to focus its resources on developing 170 MW of new productive capacity in the renewable energy segment.

It will also continue its penetration into Value Added Services, where Hera has gained extensive experience.

Excluding temporary opportunities that have been seized in the recent past, EBITDA in the Energy area is expected to grow “structurally” at a weighted average annual rate of 13% over the five-year period. In addition to the contribution of the customer base expansion in the free market and new capex, EBITDA will be boosted by the expected recovery in extraordinary shaping cost incurred in 2023.

The generation of free cash flow exceeding the absorption needs of the business itself will be used for funding a significant share of Networks’ investments and financing the distribution of dividends to Hera’s shareholders.

Attractive returns against a controlled risk profile

As a result of the action lines described in the different areas, the Group’s Return on Investment is estimated to reach 9.5% in 2028, compared to the 8.7% adjusted data of 2023.

In the five years covered by the Plan, Returns on Invested Capital are expected to grow in all businesses.

In Networks, Hera will benefit from an increase of 60 basis points in average regulated returns set by ARERA, while in the waste collection business the increase will be of 30 basis points. In the liberalised Waste businesses, namely those related to the waste treatment component, ROI is expected to grow by 340 basis points, due to market price dynamics and the increasing weight of services with higher margins.

In Energy, the ROI is expected to remain close to 20%, supported by initiatives to expand the market share, aimed to offset the lack of certain business opportunities that have been prudently considered as temporary.

| EBITDA (m€) | 2023 ROI | 2028 ROI |

Change |

| Networks | 5.1% | 5.7% | +60 bps |

| Waste (Collection) | 5.6% | 5.9% | +30 bps |

| Waste (Treatment) | 10.3% | 13.7% | +340 bps |

| Energy | 21.4%^ | 19.0% | -240 bps |

| HERA GROUP | 8.7%^ | 9.5% | +80 bps |

^Figure adjusted for Ecobonus activities

The 80 basis points increase in the consolidated ROI expected over the Plan period shows the characteristics of high visibility and low risk, given the significant weight of the regulated or semi-regulated businesses in Hera’s portfolio and the solid competitive advantages that the new investments planned will cement.