In the first quarter of 2025, results of Hera Group posted a significant improvement at P&L’s bottom line, with a 7.4% of Net Profit after Minorities due both to the contribution of an effective operational management and to a net result of financial management that reflects lower absorption of resources against a normalised external environment and an efficient debt structure.

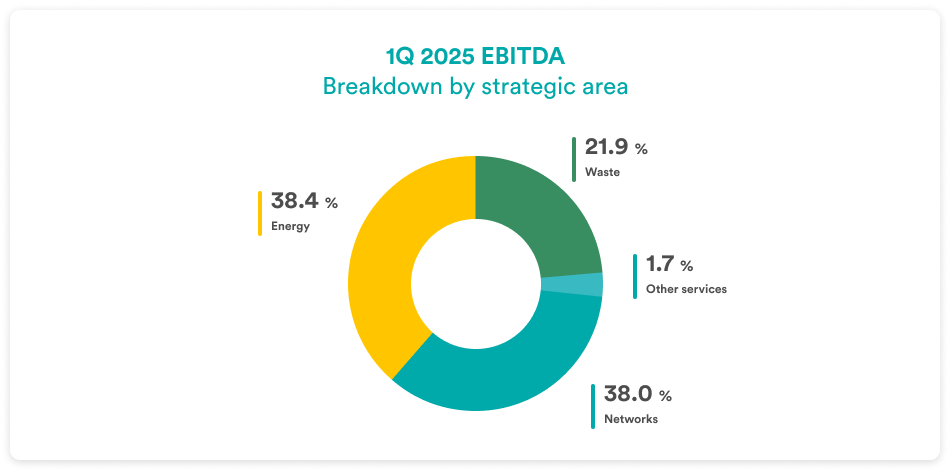

Energy is still the area making the largest contribution to Group EBITDA (160.4 m€ out of a total of 418.0 m€, with a weight of 38.4%), despite the fading of about 26 m€ of EBITDA from market opportunities that were successfully seized in the first quarter of 2024, achieving non-repeatable margins, especially in the Last Resort Market. Such driving role is followed closely by the contribution from Networks (38.0% of consolidated EBITDA for Q1). This is the area posting the strongest growth in the portfolio, with an 11.0% increase at EBITDA that confirms Hera’s ability to best capture the remunerative aspects of the regulatory framework. The contribution from Waste also remains very solid (21.9%), up 2.2% compared to the first quarter 2024, mainly due to the healthy marginality resulting from the strong leadership position.

The first quarter of 2025 also saw a significant increase (+25.6%) in Net Operating Investments, which reached 187.2 m€, in line with the objectives of strengthening the infrastructure included in the Business Plan. However, the strong cash generation fully covered the financing needs of investments, working capital and provisions, generating a surplus of 66.8 m€. This paved the way to further deleveraging, making the financial strength Hera can count on more and more evident.

| Q1 2025 (data in m€) |

TOTAL REVENUES 4,358.7 (+28.2%) |

EBITDA 418.0 (+0.2%) |

EBIT 247.2 (+0.5%) |

TOTAL NET OPERATING INVESTMENTS 187.2 (+25.6%) |

NET FINANCIAL DEBT 3,896.9 (-66.8 m€ vs 3,963.7 as at 31 Dec. 2024) |

In Q1 2025, Group Revenues reached 4,358.7 m€, up 28.2% compared to the same period of 2024. This improvement mainly reflects the increase in energy commodity prices and the growth in the Energy customer base (+20%), compensating for lower volumes of gas sold to end customers. Higher revenues were also posted in the Waste and Networks areas.

In the first three months of 2025, Group’s EBITDA amounted to 418.0 m€ – basically in line (+0.2%) with the figure for the same period of the previous year.

| EBITDA (m€) | 1Q 2025 | 1Q 2024 |

Change |

| Waste | 91.6 | 89.6 | +2.2% |

| Networks | 158.8 | 143.0 | +11.0% |

| Energy | 160.4 | 177.5 | – 9.6% |

| Other services | 7.2 | 7.0 | +2.9% |

| TOTAL | 418.0 | 417.1 | +0.2% |

The double-digit increase in Networks‘ EBITDA provided a significant contribution to the 0.2% growth in Group EBITDA, for almost 16 m€. Such increase reflects the benefits of the new Resilience Oriented Service Standard (ROSS) tariff methodology – as a result of Hera’s significant investments to strengthen the resilience of its assets in the face of severe weather events – as well as the tariff recoveries set by ARERA. More generally, that growth confirms Hera’s ability to manage all Networks’ activities to make the most of the rewarding aspects of regulation: in this first quarter, all key regulated businesses – either Water (+6 m€), Electricity (+5 m€) and Gas (+5m€) – made a positive contribution to the EBITDA of this area.

At the same time, the Waste area brought a 2 m€ increase to EBITDA, reflecting a positive trend in operating margins, driven by prudent pricing policies and the development of services, against flattish handled volumes. The result of this segment was impacted by the unavailability of full plant capacity – due to the maintenance shutdown that affected the WTEs in Padova and Forlì – and by and the renewal of hedging contracts to cover WTE generation, for about 1 m€.

Lastly, in the Energy area, the result of 160.4 m€ achieved in Q1 2025 reflects organic growth of c.9 m€, indicating an overall structural growth rate of 6%. Compared to Q1 2024, this area was affected by the lack of approximately 26 m€ of EBITDA, coming both from Last Resort Markets – where the Company managed to secure attractive margins in previous tenders – and from SuperEcobonus contributions. Therefore, in accounting terms, without extrapolating the missing 26 m€ temporary opportunities, EBITDA would decrease by 9.6%. The number of customers served – at the end of March 2025 totalling 4.6 million (of which 2.6 in electricity and 2.0 in gas) – remains a meaningful metric, which leads to high appreciation of the performance of this area: the figure shows an increase of 800 thousand units compared to the previous year, confirming Hera’s remarkable ability to retain the customers won over 2024, in particular with the tender for Gradual Protection Services as part of the liberalisation process of the Italian market.

In Q1 2025, Group’s EBIT amounted to 247.2 m€, showing a slight increase compared to Q1 2024 (+0,5%). Such difference, of 0.4 m€ compared to the first quarter of the previous year, reflects the reduction in Amortisation, Depreciation, Provisions and Write-downs (-0.3%). While depreciation and amortisation increased due to new operating investments and the acquisition of new Energy customers, provisions for bad debts declined, due to the contraction of activities in Last Resort Markets.

The Result of Financial Operations shows an improvement of 18.4 m€ compared to the same quarter of the previous year, posting a negative balance of 17.5 m€ (-51.3%). The change reflects a lower reliance on bank support due to reduced needs to cover working capital, in a normalised external environment. The figure also reflects the Group’s efficient financial structure, with a competitive average cost of debt, which, in the quarter just ended, stood at 2.8%.

Therefore, after taxes for 70.2 m€, Net Profit after Minorities amounted to 153.7 m€, a growth of 7.4% compared to the first three months of the previous fiscal year.

Net Financial Debt, which at 31 December 2024 was 3,963.7 m€, in Q1 2025 decreased by 66.8 m€, due to strong cash generation.

Thus, deleveraging continued, with a Debt-to-EBITDA ratio reaching 2.45x at 31 March 2025, the lowest level of the last two decades.