Once again, nine-month 2024 results prove the strength and effectiveness of Hera’s business model. The Group succeeded in increasing operating margins even though the normalisation of energy prices led to a 25.3% fall in Revenues, against the backdrop of an anaemic economy and the expiry of the 110% Ecobonus incentives.

EBITDA and EBIT post a growth of 3.1% and 3.5% respectively, an improvement even compared to first-half performance, while P&L bottom line shows a 20.1% rise in Net Profit post minorities.

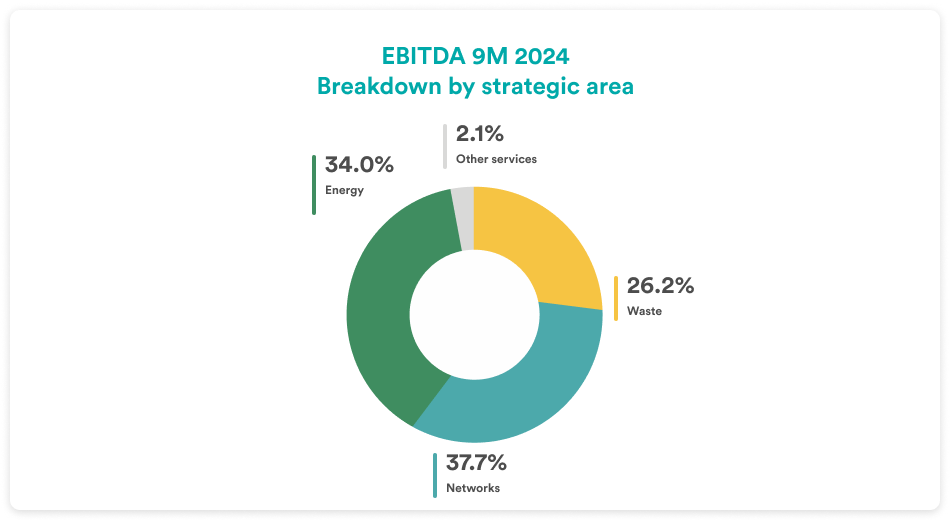

The EBITDA of both Networks and Waste has driven the growth of the Group EBITDA, offsetting the drop in the EBITDA of the Energy area, penalised by the expiry of tax incentives for energy efficiency work, though still reaching a like-for-like growth of approximately 59 m€.

| NINE-MONTH 2024 (data in m€) |

REVENUES 8,187.4 (-25.3%) |

EBITDA 1,037.6 (+3.1%) |

EBIT 522.5 (+3.5%) |

TOTAL NET OPERATING INVESTMENTS 534.8 (+3.9%) |

NET FINANCIAL DEBT 4,175.0 (+347.3 m€ vs 3,827.7 as at 31 Dec. 2023) |

In the first nine months of 2024, Group’s Revenues amounted to 8,187.4 m€, recording a 25.3% decrease over the same period of 2023. As already experienced in the two previous quarters of the year, the downward trend in Revenues reflects the return of energy commodity prices to more normal levels, as well as a decrease in volumes of gas sold, due to both the mild temperatures recorded in the first months of 2024 and the savings in consumption driven by the energy efficiency measures implemented in homes. These negative factors were partially offset by the increase in electricity volumes sold, a result of the Group’s effective marketing strategy.

Group’s EBITDA in the first nine months of 2024 recorded a 3.1% increase compared to the same period of the previous year. It reached 1,037.6 m€ because of the positive contribution coming from both regulated and liberalised businesses, even though, in the Energy area, in the first nine months of 2023 Hera had achieved 86 million euro through energy efficiency activities that could not provide the same contribution in 2024.

| EBITDA (m€) | 9M 2024 |

9M 2023 |

Change |

| Waste | 271.6 | 258.0 | +5.3% |

| Networks | 390.9 | 350.9 | +11.4% |

| Energy | 353.0 | 379.8 | -7.1% |

| Other services | 22.1 | 18.1 | +22.7% |

| TOTAL | 1,037.6 | 1,006.8 | +3.1% |

The Networks’ performance (+40.0 m€) drove the 30.8 m€ progress of Group EBITDA compared to the first nine months of 2023, as a result of the favourable impact of the WACC increase set by ARERA and the Resilience Oriented Service Standard (ROSS) – a system recently introduced by a Regulator’s Resolution, which rewards operators who invest, as Hera does, in upgrading their infrastructure to ensure more resilience to extreme weather events, thus ensuring greater reliability and continuity to their services.

Once again, during the flooding that hit the city of Bologna and the surrounding area, Hera demonstrated to have an infrastructure capable of withstanding extreme climatic events and of being able to manage the difficulties created by atmospheric events, guaranteeing a return to normal conditions for all citizens in a very short time, with timely interventions that made it possible to remove alluvial deposits and flood-related waste in just a few days, even in this case.

The Waste area also made a positive contribution to the Group’s results, through a 5.3% increase at EBITDA (+13.6 m€), despite a macroeconomic scenario that was not favourable, due to both the weakness of industrial production, resulting in less waste to be treated, and the lower prices at which energy generated by WTE is valued. Therefore, this area benefits from the increase in waste treatment services (+13 m€) and from the full implementation of the new concessions in collection (+3 m€) – factors that largely counterbalance the negative change (-2 m€) in the value of energy production of the WTE plants.

The Energy areas experience a 26.8 m€ decrease at EBITDA vs the first nine months of 2023, mainly due to the expiry of the Superecobonus incentives, given the boost this had given to energy efficiency activities in past years. However, organic growth in these areas is significant, totalling 59 m€, and was driven by the continuous increase in the customer base. Overall, at the end of September 2024 Hera had 2.65 million customers in the energy supply and 2.05 million gas customers, representing 4.7 million customers as a whole – thus recording an increase of 900,000 compared to one year earlier, mainly due to the customers gained through the liberalisation process of the Italian electricity market.

The growth recorded at the EBITDA level is also reflected at the Group EBIT level, which increases at a slightly higher rate (+3.5%), amounting to 522.5 m€. The difference in the growth rate of the two indicators is due to the deceleration of Depreciation, Provisions and Write-offs (+2.6%). Higher D&A expenses reflect new operating investments in the regulated sectors and in waste treatment, as well as activities aimed at acquisition of new customers. In the nine-month period, Provisions for credit losses decreased, as a result of the drop in the price of energy commodities and lower volumes in Last Resort markets.

In the first nine months of 2024, the Result from Financial Operations posts a negative balance of 89.0 m€, a 50.7 m€ improvement over the same period of 2023. Such performance mainly reflects the benefits coming from the recent liability management activities aimed to make the financial structure more efficient, resulting in a decline in the cost of debt to 2.7%, together with the favourable impact of tax-credit related transactions in the energy efficiency business.

The ending of certain tax benefits explains the slight increase in the tax rate, from 26.8% in the first nine months of 2023 to 28.0%, which translates into taxes for 121.4 m€.

Therefore, Net Profit after minority interests stands at 282.9 m€, a 20.1% increase compared to that of the same period in 2023.

Operating Cash Flow of 774 m€ funded the increase in Working Capital (+261 m€) and most of the Operating Capex (534.8 m€). Considering also the M&A investments (45 m€), the dividend distribution (252 m€) and the use of Provisions (29 m€), at the end of the third quarter of 2024 the negative net balanced was 347.3 m€. As at 30 September 2024, Net Financial Debt hence amounts to 4,175.0 m€, vs 3,827.7 m€ as of 2023 year-end.

At the end of September 2024, the Debt-to-EBITDA ratio is 2.7x – a level that is still in line with that of the two previous quarters and remains below the threshold of 3.0x that Hera has set to preserve its broad financial flexibility.

Lastly, as a reflection of the EBIT increase, returns significantly improve, with ROI that moves from 9% as of end-September 2023 to 9.5% of the same period in 2024 and the ROE that reaches 11.7% vs 10.6% in the same period of 2023.