FY 2024 results confirm Hera’s ability to improve its EBITDA (+6.2%) consistently despite the normalisation of energy prices, which drove a 16.2% drop in Revenues, and despite the exhaustion of the 110% Ecobonus incentives, which had generated attractive returns from energy efficiency activities in 2023.

All the KPIs of the Income Statement show significant increases compared to 2023. EBIT (+12%) grew at a higher rate than EBITDA on the back of lower Provisions, while Net Profit after minorities increased by 31.8%, also benefitting from lower net financial charges.

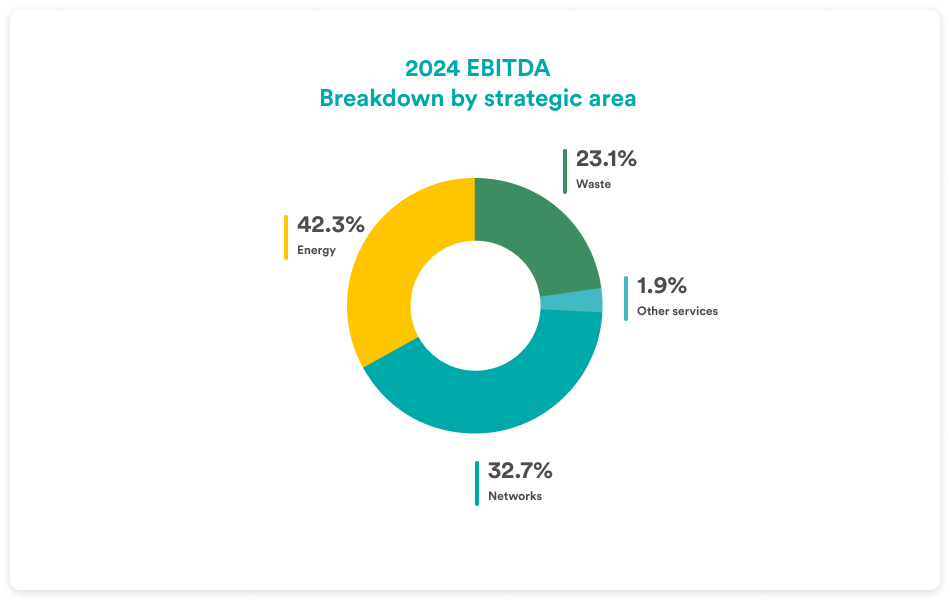

Against the backdrop of all businesses making a positive contribution to Group EBITDA, Networks played a leading role in 2024, due to a regulatory framework that rewards targeted investment and operational efficiency, through a structure that recognises the quality of the commitment that Hera devotes to these businesses in terms of resources invested and cost focus

| FY 2024 (data in m€) |

TOTAL REVENUES 13,044.4 (-16.2%) |

EBITDA 1,587.6 (+6.2%) |

EBIT 829.9 (+12.0%) |

TOTAL NET OPERATING INVESTMENTS 812.1 (+4.2%) |

NET FINANCIAL DEBT 3,963.7 (+136.0 m€ vs 3,827.7 as at 31.12.2023) |

In FY 2024, Group’s Revenues amounted to 13,044.4 m€, down 16.2% compared to 2023. The decrease was essentially attributable to the Energy area, as a result of lower energy commodity prices and lower volumes of gas sold, due to higher average temperatures and savings in consumption following energy efficiency projects carried out in homes. These factors were partially offset by higher electricity volumes sold, due to successful commercial activities, and higher revenues from system charges.

In 2024, Group’s EBITDA increased by 6.2% year-on-year to 1,587.6 m€.

| EBITDA (m€) | 2024 | 2023 |

Change |

| Waste | 367.0 | 353.4 | +3.8% |

| Networks | 519.0 | 465.9 | +11.4% |

| Energy | 671.5 | 648.7 | +3.5% |

| Other services | 30.1 | 26.7 | +12.7% |

| TOTAL | 1,587.6 | 1,494.7 | 6.2% |

The increase of 92.9 m€ vs. 2023 that the Group achieved at EBITDA level saw the contribution of all operating areas in Hera’s portfolio. Networks played a leading role (+53.1 €m), following the WACC increase set by ARERA and the Resilience Oriented Service Standard (ROSS) recently introduced with a specific regulatory Resolution – the aim of the latter being to reward operators who invest in the enhancement of the infrastructure resilience to extreme weather events, thus strengthening both the reliability and continuity of the services provided. The significant investments made in this area were reflected in a 7.4% increase in the Regulatory Asset Base, which totalled 3.6 bn€.

Despite the expiry of Ecobonus incentives in the business of energy efficiency and value-added services, which had a negative impact of 81 m€, in 2024 the Energy business areas achieved an overall EBITDA progress of 22.8 m€ compared to 2023: organic growth in these areas reached around 104 m€, driven by the continued increase in the customer base in the electricity business. At the end of December 2024, Hera had a customer base of 4.6 m, split between 2.0 m gas customers and 2.6 m electricity customers: the latter recorded an increase of 900,000 compared to a year earlier, thus proving Hera’s success in leveraging the liberalisation of the Italian electricity market.

The Waste area made a positive contribution to the Group’s performance, with an increase in its EBITDA of 13.6 €m, mostly attributable to the waste treatment business. In 2024, volumes increased from 5.4 m tons in 2023 to 5.6 m tons: a change entirely attributable to the increase of 250,000 tons in special waste treated, against a flattish urban waste collection business. In 2024, having completed the revamping processes that had involved some WTEs, Hera was able to count on the full availability of the treatment plants in its portfolio.

The Group’s special waste treatment capacity has also been strengthened by a new plant for recycling carbon fibre inaugurated in Imola, a city at the heart of Italy’s motor valley, on 11 March 2025. At present, this plant is expected to produce 160 tons of recycled carbon fibre per year, with an energy saving of 75% compared to virgin fibre.

In 2024, Group EBIT amounted to 829.9 m€, up 12% year-on-year: a higher pace than that recorded by EBITDA (+6.2%). Such difference is mainly attributable to Amortisation, Depreciation, Provisions and Write-downs (+0.5%), which grew less than EBITDA.

While Depreciation and Amortisation increased as a result of new operating investments, Provisions for bad debts decreased, reflecting the drop in energy commodity prices.

In 2024, the Result of Financial Operations improved by 61 €m, posting a negative balance of 153.8 m€. This performance essentially reflects the positive effects of the revaluation of tax credits for 2023 incentivised works and the benefits of the reduction in valuation charges for those carried out in 2024. The improved balance also reflects the reduction in financial charges due to successful liability management.

As a consequence of the exhaustion of some tax benefits or extraordinary concessions that the Group had enjoyed in previous years, in 2024 the tax rate increased from 27.3% in 2023 to 29.1%. Still, the increase in taxes from 146.4 m€ in 2023 to 200.3 m€ in 2024 is largely due to the higher taxable profit achieved.

Therefore, Net Profit after Minorities amounted to 494.5 m€, up 31.8% compared to 2023.

The robust cash generation, after absorbing a change of 183 m€ in Net Working Capital, made it possible to almost completely cover the significant Capital Expenditure (811.7 m€), M&A cash out (48 m€) and dividend distribution (251.5 m€), resulting in an increase of only 136.0 m€ in Net Financial Debt, which thus amounted to 3,963.7 m€ at 31 December 2024.

Therefore, the fast deleveraging, started in the last quarter of 2022, continued. The Debt-to-EBITDA ratio at the 2024 year-end was 2.5x: a level that is also the lowest over the last two decades.