In the first six months of 2024, Hera confirmed its continued ability to improve operating margins due to the strength of its structural business portfolio, even against a backdrop of energy prices returning to more normal levels and the expiry of the 110% Ecobonus benefits. Against a 33.3% drop in Revenues, Group’s half-year results post a 2.0% progress at EBITDA and a 2.8% increase at EBIT.

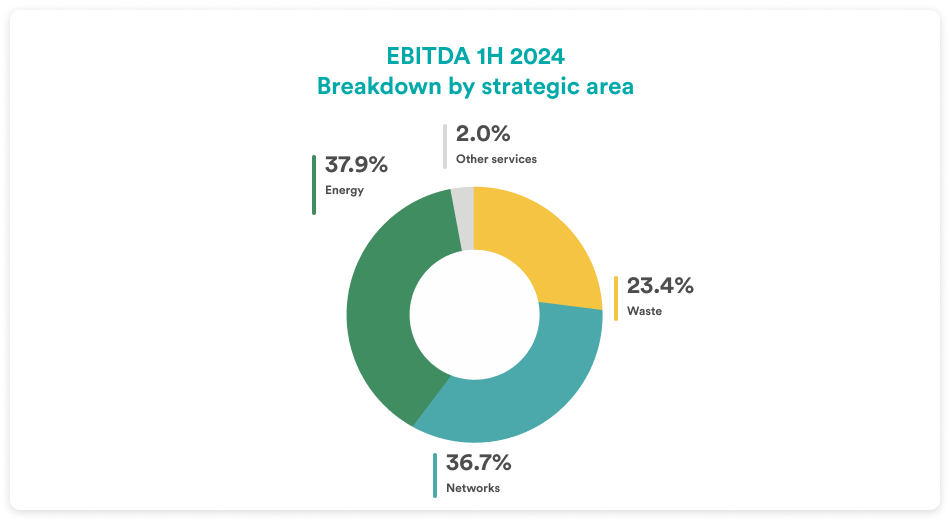

At the consolidated level, the significant increase in EBITDA of Networks (+26.2 m€) and Waste (+8.6 m€) offset the EBITDA decrease in the Energy area, which nevertheless grew on an organic basis by about 28 m€, despite a penalising comparison with the first half of 2023 due to the expiry of the SuperEcobonus tax incentives, whose negative impact that can be calculated at about 51 m€.

At the end of June 2024, the Debt-to-EBITDA ratio was at 2.69x, well below the threshold that Hera set at 3x. Therefore, the Group’s financial strength is again confirmed, and thus the ample room to seize any opportunities for growth through M&A.

| H1 2024 (data in m€) |

REVENUES 5,536.8 (-33.3%) |

EBITDA 732.7 (+2.0%) |

EBIT 385.1 (+2.8%) |

TOTAL NET OPERATING INVESTMENTS 327.7 (+7.0%) |

NET FINANCIAL DEBT 4,063.55 (+235.8 m€ vs. 3,827.7 as at 31 Dec. 2023) |

In the first half of 2024, Group’s Revenues were back at a more physiological level: the amount of 5,536.8 m€ reached at the end of June reflects a decrease of 2,760.7 m€ compared to the figure for the same period in 2023, which was 8,297.5 m€ – a number that reflected the high commodity prices during the energy crisis.

The decline in 1H 2024 Revenues of the Hera Group mostly reflects the 2,454 m€ decrease in the Revenues of the Energy areas, for the combined effect of the deflation of energy commodities and the lower volumes of gas sold – a phenomenon, the latter, due to the mild temperatures experienced in early 2024 as well as the optimisation of energy consumption by customers who have recently carried out efficiency upgrades in their homes.

The factors that negatively affected the trend in Revenues were partially offset by the increase in volumes of electricity sold due to Hera’s effective commercial action.

In the first half of 2024, Group’s EBITDA reached 732.7 m€, posting a 2.0% hike compared to 1H 2023.

| EBITDA (m€) | 1H 2024 | 1H 2023 | Change |

| Waste | 171.5 | 162.9 | +5.3% |

| Networks | 268.9 | 242.7 | +10.8% |

| Energy | 278.0 | 301.0 | -7.6% |

| Other Services | 14.3 | 11.8 | +21.2% |

| TOTAL | 732.7 | 718.3 | +2.0% |

The largest contribution to the 14.4 m€ increase of Group EBITDA vs. 1H 2023 came from the Networks’ performance (+26.2 m€). Hera benefited from the 100 bps WACC increase set by ARERA, in addition to the alignment of both RAB and OpEx to the new inflation levels. Moreover, the Group has also taken advantage of a well-focused investment policy and the achievement of further operational efficiencies, which are rewarded through regulation.

The Waste area also made a positive contribution to the Group’s EBITDA performance, having reported an increase in EBITDA of 8.6 m€, which also benefited from the integration of ACR Reggiani, a player in industrial remediation and special waste treatment, whose acquisition was closed in March 2023. Against a reduction of about 3 m€ in energy production by WTE plants, Hera recorded an increase of about 3 m€ in waste collection activities, due to the higher WACC. Therefore, the remaining part of the progress, amounting to about 9 m€, is attributable to the treatment business, which profited from a double-digit increase in special waste volumes. On the other hand, there was a slight decrease in urban waste volumes, which had been particularly high in 2023 due to the collection activities carried out after the May floods.

The Energy areas, which in the previous period could leverage a strong expansion fuelled by the market liberalisation, in first-half 2024 recorded a 23 m€ decrease at EBITDA. More thoroughly, there was an organic growth of about 28 m€, driven both by the increase of about 125,000 customers in the last 12 months, concentrated in the electricity business, and by a decrease in shaping costs due to operational and commercial optimisations, as well as a more ‘normal’ scenario. This organic growth only partly offset the drop in EBITDA (-51 m€) due to the expiry of the tax benefits for the 110% Ecobonus. However, Hera continued its Energy Efficiency activities in the first half of the year, achieving an EBITDA of 10.5 m€, despite the tax bonus being reduced to 70% and the process of transfer of credits to banks being discontinued.

In first-half 2024, Group’s EBIT amounted to 385.1 m€ (+2.8%), thus achieving a greater progress than EBITDA (+2.0%), mostly due to a decrease in Provisions for credit losses (-22.4%) against a backdrop of falling energy commodity prices, while D&A increased by 8.2%, mainly reflecting operating investments made in the Networks and Waste area.

The Result from Financial Operations, with a negative balance of 55.5 m€, posts a significant improvement, as it decreases by 35.0 m€ compared to H1 2023. This performance reflects the benefits coming from the liability management activities to optimise the financial structure that Hera carried out during 2023, resulting in a reduction in the cost of debt from 2.9% in H1 2023 to 2.7%.

Following 92.3 m€ taxes, which indicate a tax rate of 28.0% compared to that of 26.8% in H1 2023, Adjusted Net Profit after minority interests reaches 218.4 m€, posting a 16.4% increase vs. that of the same period of 2023.

At the end of June 2024, Net Financial Debt amounts to 4,063.5 m€, a 6.2% increase vs. the level at 2023 year-end, having funded an increase of c. 173 m€ in net working capital, capital expenditure of c. 328 m€ and over 250 m€ for the dividend distribution.

As at 30 June 2024, the Debt-to-EBITDA ratio therefore stands at 2.69x: a level in line with that at the end of 2023 (2.56x) and significantly below the 3.0x threshold that Hera believes it is correct not to exceed at current cost-of-money levels to continue creating value.

As illustrated in detail in the Annual Financial Report for the year ended 31 December 2023, to which reference should be made for completeness, starting from Financial Year 2022, with the aim to supplement the information prepared in accordance with IFRS, the management deemed it appropriate to present the results by valuing the natural gas inventories according to a management criterion, in order to provide a representation consistent with a market context that presented significant and sudden price changes compared to historical trends.

Already at the end of the first quarter of 2023 and for all subsequent periods, including the current one being reported, the valuation differential was fully recovered, thus affecting the change in inventories in the Income Statement for the first half of 2023, but not the value of inventories recognised in the balance sheet. The latter, in particular, reflects a write-down that derives from a book value higher than the management value, due to the effect of the residual gas in inventory whose average cost still reflects purchases made in 2022, with an extremely high price scenario compared to the current one.

Therefore, to summarise, the statutory and management valuation of inventories at 30 June 2024 is aligned, while the economic period of comparison reflects the reversal of the misalignment that arose in the year 2022 (thus affecting the change in the period, but not the stock).