In 2020, Hera leveraged the benefits resulting both from the recent acquisitions and from the synergies already extracted in the first year of their management, to continue the growth path indicated in the Business Plan. Thus, the Group achieved a 3.5% increase at EBITDA level, despite the challenging environment due to the economic effects of the restrictions to fight the spread of Covid-19 and the extremely mild weather conditions. A strong cash generation allowed for a reduction in the Net Financial Debt at year-end, with a significant improvement of Hera’s financial profile.

The last few months of the year showed a recovery in the demand from industrial clients, thus proving that Hera’s business portfolio is well structured and can offer both resilience in uncertain times and growth opportunities when the macroeconomic scenario is improving.

| FY2020 (data in m€) |

EBITDA 1,123.0 (+3.5%) |

NET PROFIT POST MIN. ADJ. 302,7 (+0.6%) |

NET INVESTMENTS 528.5 (+3.8%) |

NET FINANCIAL DEBT 3,227.0 (-1.4% vs. 31 Dec. 2019) |

In 2020, Group Revenues amounted to 7,079.0 m€, an increase of 166.2 m€ (+2.4%) compared to 2019. This result was driven by the perimeter expansion; in 2020, recent acquisitions provided an incremental contribution of 548 m€, due to the consolidation of EstEnergy from the beginning of 2020, and Pistoia Ambiente from the second half of 2019. The factors that had a negative impact on Consolidated Revenues mainly include the contraction of about 275 m€ of revenues from trading, production, and sale of electricity – a reflection of lower commodity prices and lower volumes sold. However, in the second half of the year, Hera benefitted from a progressive recovery in the demand of energy and waste management coming from the business customers that had stopped or slowed down their activities during the first Covid-19 wave.

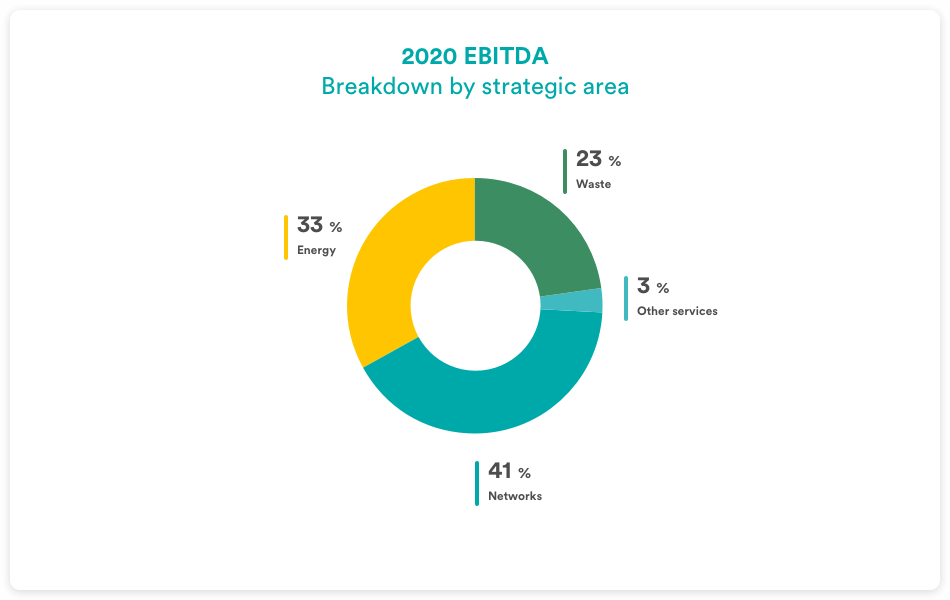

In 2020, Group EBITDA reached 1,123.0 m€, achieving a total growth of 38 m€ (+3.5% vs. 2019). Such performance proves that Hera’s consolidated strategy – which combines the lever of organic growth with that of M&A – allowed the Company to maintain a sustained pace of development despite the hard operating environment.

The effects of the restrictions introduced to contain the Covid-19 pandemic, the mild winter temperatures, and the end of the incentives on the Ferrara WTE had an overall negative impact of 43 m€ at EBITDA level.

Anyway, these negative factors were more than compensated by 81 m€ of positive impact on EBITDA due to the following two elements:

- organic growth, which offered a contribution of 39 m€, leveraging on the synergies rapidly emerging from the integration of EstEnergy, the organisational flexibility that allowed for controlling operating expenses, the extraction of efficiencies mainly through innovation and, not least, the benefits of more than 100 m€ of development capex;

- the expansion of the perimeter, with a contribution in terms of incremental EBITDA for a total of 42 m€, as consequence of the acquisition of EstEnergy (+37 m€ of net contribution) and Pistoia Ambiente (+4.8 m€).

The Energy area drove the performance of consolidated EBITDA, with a 62.6 m€ growth (+20.5%), thus proving crucial to Group’s cash generation: EstEnergy incremental contribution (+54 m€), together with more than 26 m€ organic growth and 9 m€ synergies, wiped off the negative effects of the restrictions imposed to contain the Covid-19 infections (-20.5 m€) and the mild winter temperatures (-€6.2 m). In this area, Hera’s predominant exposure to retail customers proved rewarding, as their consumption levels increased during the lockdowns due to working from home, partially offsetting the drop in demand from industrial customers.

Networks, despite showing an EBITDA reduction of 19.6 m€ (-4.1%), in this case due to the deconsolidation of gas distributions activities in Padua, remain a key part of Hera’s business portfolio, as proven by the 15.4 m€ of organic growth. The performance of the Networks area, however, reflects a negative impact of 11.6 m€ from the regulatory tariff review, especially in gas distribution, and 6.2 m€ of negative items related to the impact of Covid on connection services and lower volumes of heat sold, also due to the mild winter climate in the first quarter. In addition, the Networks performance reflects the negative aforementioned impact of 17.2 m€ for the spin-off of Hera’s gas distribution networks in Padua and Udine included in the Ascopiave deal.

The Environment area presents an EBITDA reduction of 6.2 m€ (-2.3%), which is mainly due to a weaker performance of the regulated part of waste collection, while the component related to waste treatment shows positive results. If on one hand M&A and organic growth provided a positive contribution of 11.1 m€, on the other hand the sharp drop in energy prices reduced the profitability of WTE plants (-8.6 m€), as well as the end of some incentives (-4.3 m€). The impact of Covid-19 had a negative effect for 4.4 m€, due to the drop in the demand from industrial customers during the most severe phase of lockdown. Counting on a solid infrastructure, with the economic recovery, Hera can therefore achieve significant increases in volumes.

| EBITDA (m€) | 2020 | 2019 | Change |

| Waste | 258.0 | 264.2 | -2.3% |

| Networks | 460.6 | 480.2 | -4.1% |

| Energy | 367.8 | 305.2 | +20.5% |

| Other services | 36.7 | 35.5 | +3.4% |

| TOTAL | 1,123.0 | 1,085.1 | +3.5% |

Changes in the scope of consolidation are the main driver of the 29.1 m€ (+5.4%) increase in Depreciation and Amortisation, which amounted to 571.7 million euro. So, EBIT improves by 1.6% compared to 2019, reaching 551.3 m€.

The result of the area of financial management is 116.7 m€, an increase of 16.7 m€ (+16.7%) compared to 2019. The change is essentially attributable to the notional charges of 19.3 m€ that derive from the put option envisaged by the Ascopiave agreement. Actually, during 2020, Hera’s cost of debt decreased from 3.5% to 3.0%, as a result of the successful liability management operations, including the bond issue for 500 million euro launched in November at a 0.25% rate.

Tax rate shows a strong improvement, as it drops from the 28.3% of 2019 to 25.7%, mainly due to the tax optimisation allowed by the investments focused on innovation.

In 2020, Net Profit post minorities adjusted is 302.7 m€ (+0.6%). This change incorporates the adjustment of the result from special items (+84.9 m€) in the 2019 P&L.

Net Financial Debt, which stood at 3,277.0 m€, sees a 47.2 m€ reduction compared to 3,274.2 m€ at the end of 2019. This improvement comes from the strong cash generation, which made it possible to fully cover investments, as well as the disbursements for dividend payment, buyback, and M&A transactions, in addition to the purchase of a 4.9% share in Ascopiave. The Net Debt-to-EBITDA is 2.87x, compared to 3.02x at the end of 2019.

In 2020, Hera’s active commitment to pursue sustainability objectives also continued.

CSV (Creation of Shared Value) reached 420.0 m€, i.e., 37.4% of EBITDA, increasing by 7.2% compared with 391.7 m€ in 2019. This result also reflects the significant investments in CSV that Hera has made in 2020, for a total amount of 297 million euro.