| 2017 (dati in mn€) |

REVENUES 5,612.1 (+9.4%) |

EBITDA 984.6 (+7.4%) |

EBIT 479.3 (+4.9%) |

NET INVESTMENTS 396.2 (+8.1%) |

NET FINANCIAL DEBT 2,523.0 (-1.4%) |

- Prove the effectiveness of our business model, which leveraged on efficiency, innovation, agility and excellence in achieving organic growth.

- Confirm that strong cash flow generation allowed for additional growth via M&A, while improving financial strength.

- Show, along with the positive contribution from the different Hera’s business areas, the key contribution to the growth of bottom line coming from management of both the financial and fiscal area.

- Lastly, prove that projects and investments put into play with a view to Shared Value translated into material results, as they now represent over one third of overall EBITDA.

The 480.8 mn€ growth in Group Revenues (+9.4%) reflects the contribution of 110.7 mn€ from recent acquisitions, especially from Aliplast (109 mn€), Italian leader in plastics recycling, which entered the consolidation scope starting from 1st January 2017. In terms of organic growth, Revenues increase by 370 mn€, mostly driven by Trading activities (300 mn€) and revenues from gas and electricity sales, which benefit both from the price increase in commodities (60 mn€) and from higher volumes sold (28 mn€). Lastly, the contribution from revenues in the Water business is not negligible, as it amounts to 22 mn€.

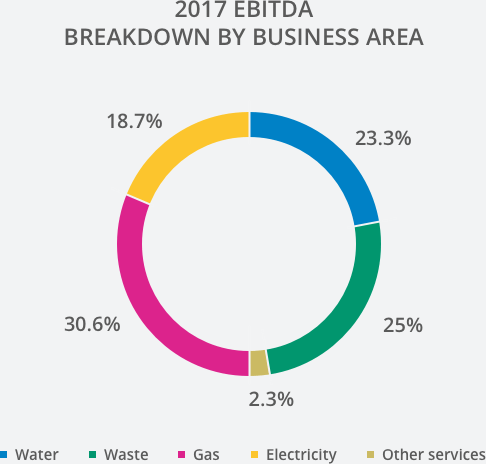

All business areas contributed to the 68 mn€ increase in EBITDA (+7.4%). The strongest performance was recorded in the Electricity area (+49.2 mn€), thanks to the expansion in the number of customers (+101.4 thousands) and the good margins in the safeguard customer segment. The Waste area also provided a substantial contribution (15.3 mn€), due to the inclusion in the consolidation scope of Aliplast and Teseco and the increase of prices in liberalised activities. All in all, those drivers have counterbalanced the impact of lower revenues from white certificates (-24 mn€) and lower energy production from two WTE plants, in Padua and Ferrara, which had a stoppage in the first part of the year. The Gas area, whose EBITDA increases by 1.1 mn€, reflects the sound margins in trading and the good performance of revenues in regulated services, which managed to offset the weaker performances of district heating, affected by mild temperatures. Lastly, in the Water area, the 1.1 mn€ increase in EBITDA was driven by higher revenues from dispensing, against lower connection revenues and operating costs, whose dynamics were influenced by un

favourable weather conditions: in 2017 precipitation 30% lower than historical average has made necessary to purchase higher water volumes.

| EBITDA (mn€) | 2017 | 2016 | Change |

| Waste | 246.0 | 230.7 | +6.6% |

| Water | 229.9 | 228.8 | +0.5% |

| Gas | 301.7 | 300.6 | +0.4% |

| Electricity | 184.5 | 135.3 | +36.4% |

| Other services | 22.5 | 21.3 | +6.1% |

| TOTAL | 984.6 | 916.6 | +7.4% |

Group EBIT grows by 4.9%, despite the 9.9% increase in Depreciation and Provisions, due to acquisitions and higher operating activities.

The financial management area shows a 15.9 mn€ decline in net charges compared to 2016 (-13.5%), as a result of an average amount of net debt kept under control and the optimisation of its cost; finally, the interest recovery on debt claims for safeguard customers also provided a positive contribution.

In the fiscal management area, the tax rate decreased from 35.1% in 2016 to 29.6%, due to the cut of 3.5 percentage points in the corporate tax rate (IRES) and the fiscal optimisation linked to the tax credit for R&D, super depreciation and patent box.

Net Profit after Minorities in 2017 therefore stood at 251.5 mn€, with a 21.3% increase vs. the previous fiscal year.

Cash Flow from Operations, equal to 306.5 mn€, allowed for the payment of 2016 dividends (140.4 mn€) and the full funding of the acquisitions closed during the year. The resulting free cash flow allowed for a 35.9 mn€ reduction of Net Financial Debt, which at the end of 2017 was 2,523.0 mn€, with a 35.9 mn€ decrease compared to the end of the previous year. The Net Debt-to-EBITDA ratio therefore improved, moving from 2.79x in 2016 down to 2.56x in 2017.

Starting from 2016, within the framework of the Sustainability Report, Hera started reporting the EBITDA generated through shared value activities. The 2017-2021 Business Plan envisages that around 40% of the 2021 EBITDA will come from businesses that deliver concrete responses to those priorities in the global sustainability agenda that overlap with Hera’s operational areas. The results achieved in 2017 show encouraging progress: shared value EBITDA reached 329 mn€, a 10% increase over the previous year, and weighted for 33.4% of consolidated EBITDA.

A number of projects and results, related to three specific priorities, are listed below. They indicate that Hera has a very factual and diversified approach in its commitment to achieving an ever-growing weight of shared value EBITDA on total EBITDA.

Reduction of 3.6% in energy consumptions vs. 2013

Increase in purchased renewable energy for corporate use

Increase in Hera production of renewable energy (614 GWh)

Decrease of 16% of the carbon footprint in the energy production vs. 2015

New commercial offers in 2017: Welcome Hera, Hera Led, and Led Business

Digital solutions for real-time monitoring of consumptions by

Commitment to transition towards circular economy

Additional reduction in the use of landfills for urban waste disposal (7% vs. 2016 Italian average of 28%)

Production of around 103 thousand tons of recycled plastics at Aliplast

91% of urban areas meeting sustainability standards in sewage and purification plants at 2017 YE

Processes of services digitalisation

Growing use of both the Acquologo and Rifiutologo app: 30,000 alerts from customers

Launch of MyHera app in 2017

18.9% of customers subscribers of online service at 2017 YE

Electronic bill for 20.2% of clients