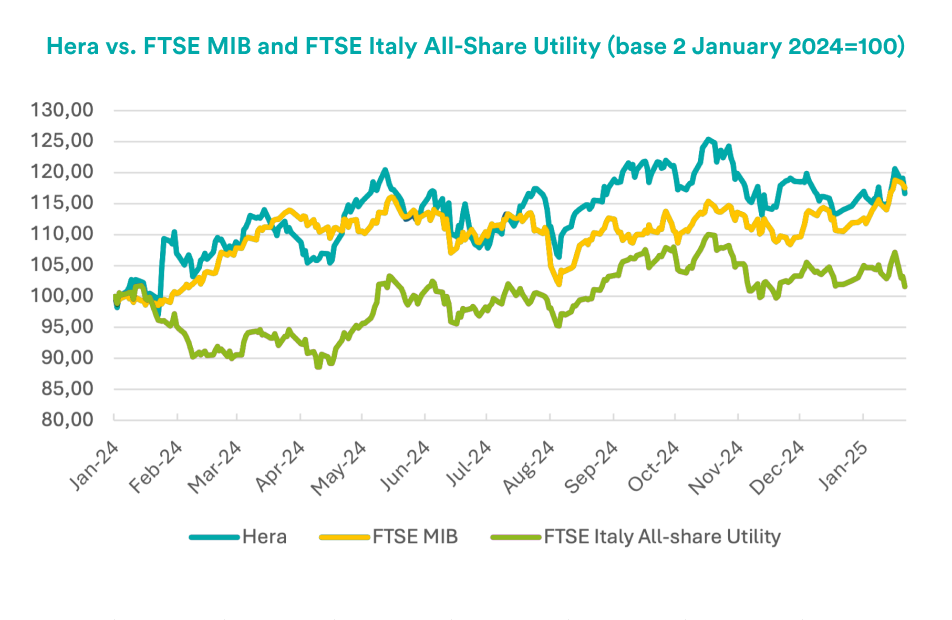

Hera continues to show robust performance against benchmark indices, even though the prospects for M&A in the banking sector have fueled a conspicuous recovery of the FTSE MIB in recent weeks. Moreover, the outperformance of the stock compared to the Italian utility sector index remains very strong.

In the meantime, today the picture is enriched by new features, which will encourage a reconsideration on the valuation of Hera stock. Preliminary 2024 figures indicate that the Group exceeded consensus expectations, achieving, in the first year, a very convincing execution of the 2023-2027 Plan that the new management had presented in January 2024.

Leveraging on the additional credibility gained, today Hera has all the premises to see the Plan to 2028 favourably received. While remaining fully in the wake of the previous one, which had been widely appreciated for the validity of its strategic approach, the new planning exercise envisages elements of further improvement that will certainly raise investors’ interest. Leveraging the prospects of being able to post even greater value creation, Hera expects to deliver its shareholders a double-digit Total Shareholder Return, around 11%, deriving from a dividend yield close to 5% and a weighted average annual rate of Earnings per Share growing approximately by 6%.

Despite an external scenario of great uncertainty, which has weakened estimates of GDP growth in Europe, Hera therefore continues to be an ideal story for capturing the benefits of falling interest rates against high visibility of future returns, leveraging on the solid structure of its multi-business portfolio.

We go deeper into these issues by asking some questions to Jens Klint Hansen, Head of Investor Relations of Hera Group.

What do you expect the reflections of the 2025 scenario will be for Hera stock?

Hera represents a viable investment solution to deal with the uncertainties currently posed by the external scenario. Due in part to tensions on the geopolitical chessboard, GDP growth in Europe is expected to slow. This environment affects the demand for products and services of companies that cannot count on strong competitive advantages while appreciating businesses less tied to the business cycle, such as utilities. On the other hand, let’s not forget that expectations for further monetary policy easing in Europe suggest a reduction in the cost of debt. Now, as much as Hera boasts balanced leverage and has just unveiled a fully self-financed investment plan, it is nonetheless a beneficiary of less restrictive monetary policies, as a reduction in interest rates paves the way for lower WACC. In turn, this is something that, in addition to improving value creation by allowing a greater differential over ROI, leads to more generous valuations in models based on discounting future cash flows.

Therefore, we can state that in the current scenario,

Hera is ideally positioned to offer resilience and low risk profile

in its results, against an external environment of stunted growth.

At the same time, Hera represents the perfect share

to capture the positive effects of falling rates.

Which of the aspects specifically related to Hera’s prospects might influence the share performance?

The Plan approved yesterday by the Board of Directors has, in many respects, a higher value compared to that of a year ago. First, the preliminary 2024 figures indicate that the results were beyond expectations – and not only beyond those of analysts in coverage. Indeed, the market had certainly highly appreciated the content of the Plan to 2027 of the new management. With these preliminary results, however, Hera has also offered eloquent evidence of execution capability that makes the development path even more credible. The Plan also presents, compared with last year’s, a greater number of operating investments to support organic growth and a much more visible M&A component, due to the AIMAG transaction just announced. There are also a few factors that can offer a potential upside compared to the targets indicated for 2028, starting with the synergies that the AIMAG integration might generate. In fact, these synergies were not included in the planning since the deal has not been signed yet. Not least, this Plan has an ESG component that provides a substantial contribution in driving growth, with significantly higher figures than what we had expected to achieve in the past in activities related to circular economy and decarbonisation paths that will lead us to Net Zero. These are, after all, real features of Hera’s profile, which are also acknowledged and appreciated in external assessments, as the top ranking in the Dow Jones Sustainability Index again proved a month ago: with a score of 80/100, Hera resulted in being the best Multi & Water Utility on a global scale, in an industry with an average of 34/100.

Also looking at “Company-specific” factors,

we can thus say Hera has all the premises to be

a stock that investors will consider including in their portfolio,

due to its low risk, visible growth profile, but also for

the deeply sustainable nature of the activities driving the growth itself.

How are the analysts currently positioned in their coverage?

The framework of recommendations is consistently positive, with only one neutral rating and all other recommendations leaning towards buying Hera shares.

The consensus target price keeps improving – following the results of the third 2024 quarter it reached 3.94 euro per share. We expect analysts to update their evaluations in light of the 2024 preliminary results and the new goals of the Plan to 2028 released today. We should note that the gap between the average target price prior to the Plan’s publication, at 3.94 euros, and recent trading levels is already well above 10%: the sell-side sees significant potential for further appreciation for Hera.

| Broker | Rating | Target Price (€) |

| Banca Akros | Buy | 3.80 |

| Equita Sim | Hold | 3.65 |

| Intermonte | Outperform | 4.00 |

| Intesa Sanpaolo | Buy | 3.90 |

| Kepler Cheuvreux | Buy | 4.00 |

| Mediobanca | Outperform | 4.30 |

| Average | 3.94 |

What is your strategy, in terms of Investor Relations, to ensure that the new Plan will have the best possible exposure to the financial community?

We designed an intensive marketing programme that will be shaped through a longer and wider roadshow compared to last year’s. We will touch new financial centres, exploring different ways of meeting with investors, such as Open Group Meetings, with the aim of maximising the number of new contacts. We will expand the European roadshow to the Iberian Peninsula and go to rediscover Scandinavia, leveraging the important ESG DNA that characterises both 2024 and future results.

Are USA investors still a target?

Certainly. And with a greater focus than last year because it is a market that has always appreciated consolidation stories – an element that in Hera’s new plan is visible and real already in the short term. On top of going to NYC, Boston and Chicago, this year we aim also at meeting investors of Denver, San Francisco and Los Angeles, exploiting the opportunities of virtual meetings.