The rally that Hera’s shares have experienced since last October has only partly covered the wide appreciation room against the average target price of analysts in coverage – currently at 3.53 euro.

Preliminary results for the Year 2023, above market expectations, will provide further visibility on management’s actual ability not only to hit strategic targets, but to achieve them well in advance. The presentation of the new Plan, which gives stronger impulse to growth through a broad investment plan, will make the extent and quality of future cash generation even clearer, while risk profile remains under control.

For shareholders, this means being able to benefit from prospective returns that reflect the dynamics of the underlying fundamentals, with a dividend per share development path that will lead to 16 eurocents in 2027.

In the following interview, we ask a few questions on those topics to Jens Klint Hansen, Head of Investor Relations of Hera Group.

How would you comment on Hera’s recent performance on the equity market?

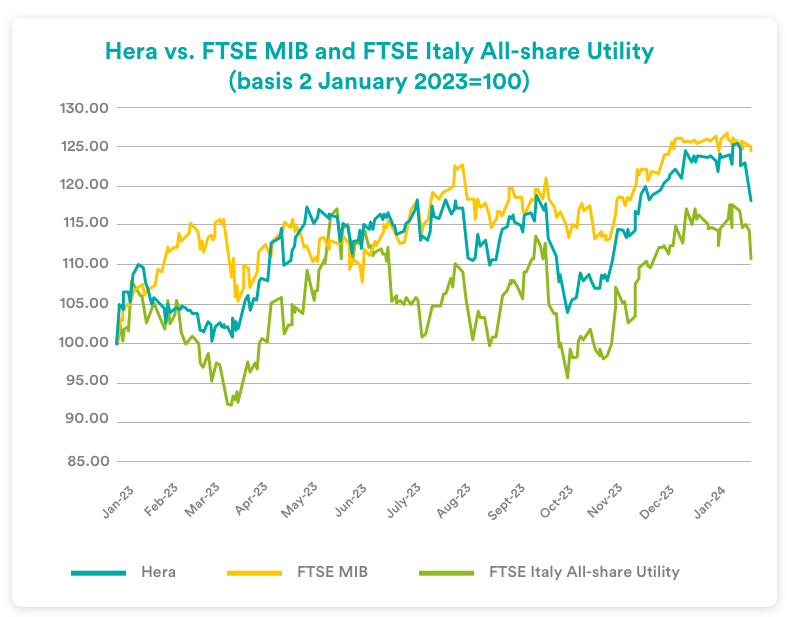

After bottoming at a new low on October 3rd at 2.48 euro, below the level of the beginning of 2023, Hera’s share price hit a turning point, setting a rally that led it to 2.97 euro at year-end. In the first trading days of 2024, the stock then posted new highs at 3.04 euro, showing persistent resiliency despite the rapid upward movement. This share price appreciation, partly attributable to the healthy fundamentals presented in November with the results of the first nine months, was also part of a general recovery movement of the whole stock market.

Which were the main factors influencing the markets in recent months?

Signs of cooling inflation in many regions led investors to see the end of the Central Banks’ tightening cycle closer. Although both the Fed and the ECB had indicated that the war against inflation was still far from being won, risk appetite has risen in the financial markets and the expectation that rates will certainly remain high for longer, but not as high as one might have feared a few months earlier, has become more firmly established. With the start of the year, the escalation of geopolitical tensions then partly curbed this positive sentiment, but without jeopardising it.

Does this picture open up new prospects for utilities?

I would say so. The strong inverse correlation with interest rates makes it one of the sectors benefiting from a more accommodative attitude from central banks. The defensive aspect of the business then remains an important protection against the possible escalation of geopolitical risks. Finally, the contribution that virtuous companies in the utilities sector make to the materialisation of megatrends such as decarbonisation or greater circularity is not negligible. Companies like Hera also provide visibility into the continued progress of future performance that is much sought-after by investors at a time when economic growth remains highly uncertain globally.

In this sense, will the presentation of the new Plan to 2027 provide new elements to investors and analysts?

I think that the release of new targets, together with the preliminary results for the Year 2023, will bring to light new elements that will allow the financial community to assess the stock even more appropriately. After all, Hera speaks the language of the market in its Plan. The strategy is clearly focused on value creation, with investments selected according to a risk-return rationale that is similarly used by fund managers when building their portfolios. Our equity story is highly consistent, because we remain a growth story with a very low risk profile, but the quality and magnitude of the returns we can offer to shareholders in this Plan is much more attractive than in previous Plans.

Which returns can shareholders expect?

For the 2023-2027 period, the new Plan envisages on average an annual Total Shareholder Return higher than 12%, compared to the 8% return offered in the previous Plan. The Total Shareholder Return component related to the dividend remains very attractive, with a 5% yield calculated on the 2023 year-end price, if we consider the dividend of 14 eurocents per share that will be proposed by the Board of Directors. The remuneration policy also sees a continuous growth over time of the dividend per share, up to 16 eurocents in 2027. Also worth noting is the second component, related to the growth of Earnings per Share, which is expected to increase at an annual rate of more than 7% over the period covered by the Plan. Hence, the TSR exceeds 12% per year.

How do the brokers covering the stock evaluate Hera?

The consensus target price is now 3.53 euro, still on the rise when compared to the 3.51 of the past November 7th, following the release of the results of the first nine months of 2023. This is a consensus price almost 20% higher than the recent trading levels, which leads five out of six analysts to recommend buying Hera shares. The only broker with a neutral recommendation has however recently increased its target to 3.4 euro: here too, the analyst indicates that there is a margin of appreciation of about 15% compared to the prices of the last trading sessions.

| Broker | Rating | Target Price (€) |

| Banca Akros | Buy | 3.60 |

| Banca IMI | Buy | 3.50 |

| Equita Sim | Hold | 3.40 |

| Intermonte | Outperform | 3.30 |

| Kepler Cheuvreux | Buy | 3.40 |

| Mediobanca | Outperform | 4.00 |

| Media | 3.53 |

Analysts will update their estimates after the presentation of the 24 January.

Will you also have direct talks with investors on the buy-side?

Of course. Immediately after the presentation, we will leave for what will be the first major roadshow of the new management team. We will meet the portfolio managers of important asset managers in London, Paris, New York, Chicago, and Sydney, to be followed by meetings in other financial centres in central and northern Europe. A very extensive and busy calendar, which will allow us to give this Plan the visibility it deserves.