After the presentation of the Business Plan to 2026 on 8 February 2023, with today’s release of FY22 results, Hera does provide investors with additional confirmation of the founding elements of its equity story.

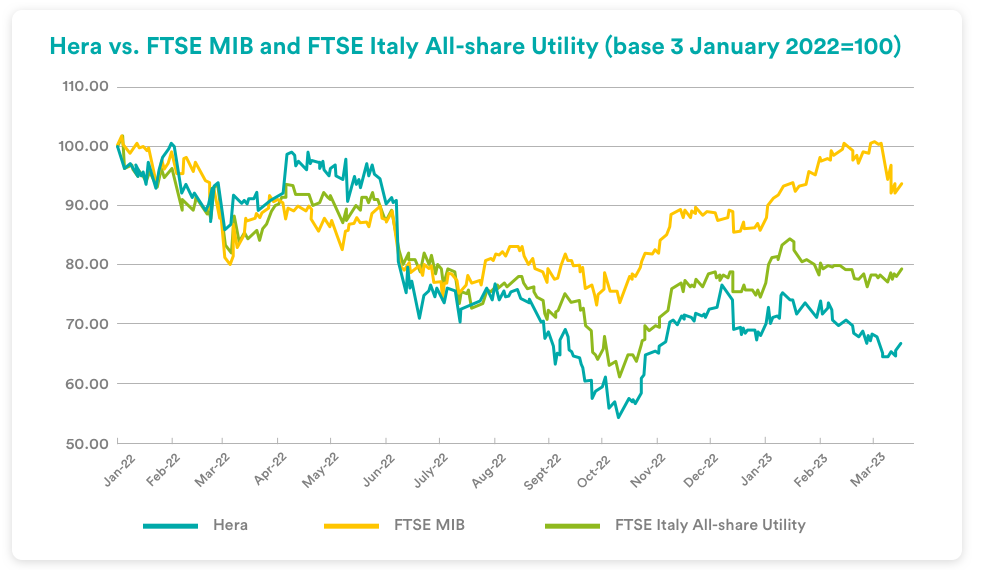

To some extent, analysts have already built in their valuations the features of Hera’s continued growth, achieved by carefully managing the risks of the external scenario. As of 20 March 2023 – before the 2022 annual results are known – brokers have a mean target price of 3.24 euro, over 30% above recent trading prices.

The numbers in the 2022 Annual Report exceed market’s expectations. Therefore, they may provide a reason to reconsider how much Hera’s healthy fundamentals are currently embedded in the share price, thus offering investors an opportunity to realise the potential room for appreciation.

In terms of dividend yield, investors already have ample visibility that, at recent prices, they can expect a remuneration exceeding 5%, based on the proposed distribution of a 2022 dividend of 12.5-euro cents per share, which shareholders will be asked to approve at the next Annual General Meeting on 27 April 2023.

We explore these topics by asking some questions to Jens Klint Hansen, Hera’s Head of Investor Relations.

What new elements are now available to the market to evaluate the Hera stock?

At the beginning of February, we presented the new Business Plan, with messages and numbers confirming a path of continued growth. The targets were raised even above those in the previous Plan, while keeping the scenario assumptions unchanged.

Considering the turbulent external context, offering more growth, while maintaining a controlled risk profile, is a challenge that very few companies other than Hera can afford today. Our multiutility model has allowed us to post an uninterrupted series of EBITDA progress over the past 20 years, with a growth that brought us from nearly 200 million euro of 2002 to almost 1.3 billion euro of the last financial year, systematically meeting or exceeding, from year to year, the targets we set out.

As we will continue to stick to that business model, the results we expect to achieve in the future are very visible. Therefore, Hera presents itself – also in this Plan, which is very consistent to the historical approach – as a company that is very focused on maintaining a prudent risk profile. How could it be otherwise? Suffice it to say that having exceeded 20 billion euro in revenues in the last financial year, Hera is now the largest company in the Emilia Romagna region.

A group of this size, which, moreover, manages primary utility services, certainly cannot be exposed to market volatility.

How has the financial community perceived this new Plan?

We recently came back from a roadshow across the major financial centres, during which we met with several international investors. The 2022-2026 Business Plan has further cemented our equity story, specifically because of its confirmatory nature. Investors appreciated the promptness and acumen with which the management reacted to the threats posed by the energy crisis during 2022, shielding the Company from potential risks on gas supplies, through the policy of purchasing large quantities to be held in storage.

What is the current consensus of analysts covering Hera?

Today the consensus is made by seven analysts. Banca Akros has recently published a new piece of research with which it resumed their coverage of the share. With a target price of 3.2 euro, more than 30% higher than recent price levels, the analyst’s recommendation could only be to accumulate Hera shares in the portfolio. This valuation is in line with the consensus: the average target price is currently of 3.24 euro, with the majority of ratings that suggest buying the stock. Even the broker with the most conservative valuation, of 2.90 euro, indicates that there is room for potential appreciation of more than 20% from the recent levels at which the stock is trading.

| Broker | Rating | Target Price (€) |

| Banca Akros | Accumulate | 3.20 |

| Banca IMI | Buy | 3.40 |

| Equita Sim | Hold | 3.30 |

| Exane BNP Paribas | Buy | 3.30 |

| Intermonte | Neutral | 3.00 |

| Kepler Cheuvreux | Neutral | 2.90 |

| Mediobanca | Outperform | 3.60 |

| Average | 3.24 |

How do you expect the 2022 results you released today to be received?

We are presenting a very healthy set of results for the 2022 financial year, with all the KPIs in the Income Statement showing growth, while the year-end debt is already significantly lower than at the end of September, due to the positive impact of gas withdrawals from storage during the thermal season: a trend that will lead us to sharply decrease inventory, with benefits in terms of debt reduction. The actual results for 2022 exceeded our internal budgets but also beat analysts’ estimates: therefore, we expect a positive impact. The key aspect for a correct interpretation, however, is that these 2022 results, although exceeding expectations, are not an exploit, but a milestone on the path of continued growth indicated in the 2022-2026 Plan.

Your equity story hinges on the returns you promise to deliver to shareholders. What indications come from the dividend for 2022?

In the Shareholders Meeting of 27 April 2023 shareholders will be asked to approve the distribution of a 12.5-euro cents dividend per share, as proposed by the Board of Directors.

The dividend is 0.5 cents higher than that for 2021. With the proposed dividend for 2022, the yield, calculated on recent prices, is well above 5%. So, even in a financial year that saw a very complex and volatile external scenario, Hera manages to offer a growing remuneration to its shareholders. Investors will then be able to assess how well the sound fundamentals – confirmed once again by the magnitude and quality of the 2022 performance – are now reflected in the stock market valuation and assess the component of a potential capital gain.