In the new Business Plan to 2025 Hera expresses its commitment to make a concrete contribution to the path towards greater environmental sustainability, through a significant capital expenditure and investment plan of 3.8 billion euro in total.

The cumulative capex and investments over the 2021-2025 period, due to the careful allocation in different business areas, help fuel a strong growth of EBITDA, which is expected to reach 1.4 billion euro at the end of the Plan.

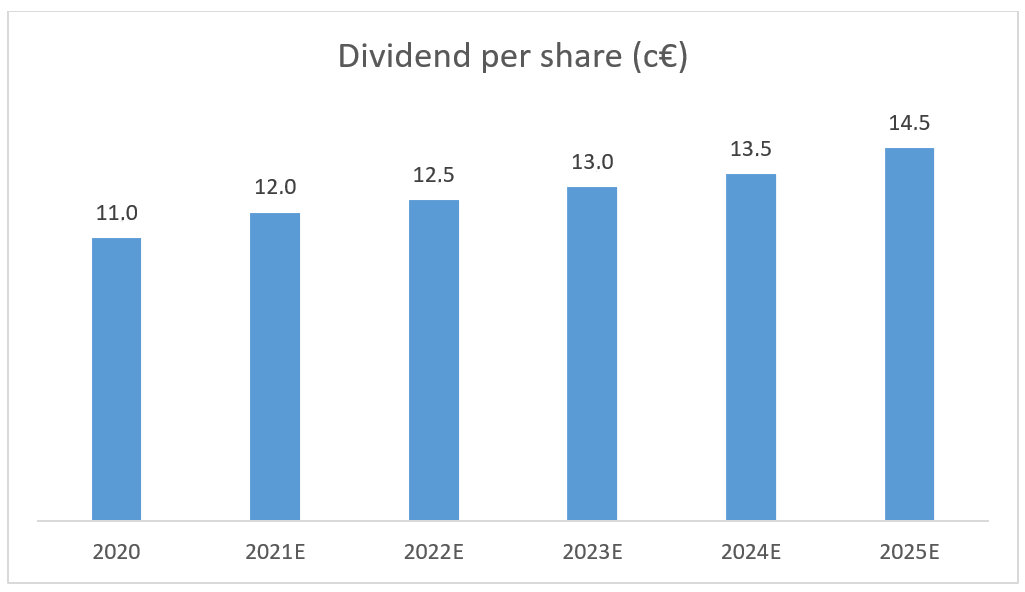

Given the high returns expected from the projects put into play, the new Plan also offers a greater shareholder remuneration compared to the previous Plan, with dividends constantly increasing, up to 14.5 euro cents in 2025, while maintaining a solid financial profile.

Preliminary 2021 results provide many confirmations on historical trends, while also giving an eloquent signal on the potential organic growth that Hera can achieve.

With an EBITDA of 1,220 million euro and a Net Debt-to-EBITDA ratio of approximately 2.7 times, according to the preliminary results, 2021 is shaping up to be a financial year in which we have marked one of the most sizeable organic growths since the Hera Group establishment. This result is even more remarkable if we consider that it has been achieved while maintaining our financial strength, despite the significant investments made, for 650 million euro.

“I would also add that those healthy 2021 results are the best way to celebrate the milestone of 20 years since the Group inception”.

At the same time, they enhance the visibility of future targets, being the result of a true vocation for sustainability. These results also derive from a winning strategic approach, which evolved over time depending on external scenarios, but has always been focused on one hand on the organic growth coming from a careful allocation of capital, and on the other hand on a M&A policy that is very selective in identifying targets and capturing synergies in the subsequent integration processes.

Lastly, with the 2021 results we have confirmed the uninterrupted growth trend that characterises Hera’s EBITDA, with a 10% CAGR since 2002.

The substantial dividend increase that the Board of Directors will propose for 2021 reflects an above-target EBITDA performance

In the last financial year, we also significantly exceeded the EBITDA target of 1,135 million euro that we set in a plan five years ago. Therefore, given the strong progress of preliminary 2021 data, at the March meeting for the approval of the annual results, the Board of Directors will propose the distribution of a 12 euro cents per share dividend, up by 9% compared to the 11 cents of FY 2020 and definitely higher than the 10.5 cents originally indicated for 2021. The proposal will have then to be approved at the next Annual Shareholders’ Meeting.

In light of market dynamics, Hera has a number of different investment options available

“The new Plan is set in a scenario that offers attractive investment opportunities. This is why we will invest heavily, focusing on projects with the most visible and attractive returns.”.

Over the next five years, in regulated businesses, we will have the opportunity to participate in the tenders for the renewal of four concessions in waste collection and gas distribution. We face these competitive processes with the strength that comes from having won all the tenders in which we have participated in our core territories – from the one for gas in Udine to the one for the water cycle in Rimini, ending with the three tenders for waste collection won in Emilia-Romagna.

In the energy sales business, we will be careful to seize the opportunities of liberalisation in the Italian retail market. In the segment of “maggior tutela” customers, i.e., those needing greater protection, where the liberalisation process has already started, we have already conquered about a third of the customers on the table. Thus, we have gained a valuable experience on the tender procedures to be applied to the liberalisation of the retail market, where about 15 million customers are still under “maggiore tutela”.

A third area on which we will focus our attention is that of a specific selection of M&A targets, as part of an ongoing process of concentration in markets that still see the presence of numerous small operators, not only in regulated activities but also in those liberalised ones, as in the case of energy sales or waste treatment.

Clear acceleration of investments, with an allocation that pays attention to ESG objectives, in view of attractive returns

The attractive opportunities provided by the external scenario and the awareness of being able to leverage on the robust platform of infrastructure, facilities, and expertise that we have built in recent years has led us to plan investment projects for a total of 3.8 billion euro in the 2021-2025 period, i.e., 641 million euro more than the cumulative investments of the 2020-2024 Plan.

Development capex, which amounts to 1.8 billion euro, represents 46.5% of the total, with the organic component, equal to 1.3 billion euro, that has the greatest weight, being 75% higher than in the 2020-2024 Plan. Finally, we plan to allocate over 300 million euro to M&A and around 160 million euro to gas distribution tenders.

Organic growth drives EBITDA

The expected returns from planned investments will boost EBITDA growth, which we forecast that will account for 277 million euro over the Plan’s period, in order to reach and EBITDA of 1.4 billion euro in 2025.

“Organic growth, with an expected contribution of over 190 million euro, will be the largest component.”

We expect to be able to benefit from an increase in market shares in energy sale, where we aim to reach 4.5 million customers, and in waste treatment, where we expect to increase annual volumes of 600 thousand tons. We will also continue to expand value-added services and develop energy efficiency projects. Finally, the expansion of plant capacity will enable us to increase volumes and revenues.

While from M&A transactions we expect a contribution of approximately 100 million euro, we also aim to create efficiencies for additional 100 million euro over the Plan’s period, as we can rely on a well-structured and scalable platform that will allow us to add revenues without expanding the cost basis.

“Given the increasing importance of value-added activities, and in general activities that absorb less capital, we expect that EBITDA increases can be translated into EBIT increases to a greater extent than in the past.”

Against an average annual growth rate of 4.5% at EBITDA level, we expect EBIT to increase on average at a rate of 5.0% per year.

The dividend policy remains based on a “floor”, on top of which the annual earnings increase is added

Based on expected Earnings per Share, which go up from the 20.6 euro cents of 2020 to 22 cents in 2024 and 27.3 cents in 2025, the new Plan envisages a growth profile of the dividend per share that will be aligned to the dynamics of the EpS, which over the five-year period has an average annual growth rate of 5.7%.

Therefore, we can conclude that in these 20 years we have successfully worked to build a platform that today allows us to catch the right opportunities to accelerate growth. That will provide benefits to all stakeholders, starting with remuneration of our shareholders.