Hera starts 2023 on a growth path. All KPIs are up compared to the first quarter of 2022, while Net Financial Debt decreases by €472.2 m, thus taking the Debt-to-EBITDA ratio down to 2.84x.

The Energy and Waste areas, which outperformed the Group average growth, have driven the 9.4% increase in EBITDA. The quarterly results achieved indicate that Hera continues along the Business Plan’s growth path, by leveraging on its proven ability to manage the operating businesses with prudence and foresight, while riding the opportunities of the scenario and continuously investing in the quality of its assets.

The sharp reduction in the level of Debt as at 31 March 2023 reflects the strong cash generated during the quarter, with a significant contribution from the depletion of gas reserves in storage, in line with the Company’s plans.

| Q1 2023 (data in m€) |

REVENUES 5,750.1 (+6.2%) |

ADJ. EBITDA 410.2 (+9.4%) |

ADJ. EBIT 236.1 (+6.7%) |

NET OPERATING INVESTMENTS 166.1 (+33.3%) |

NET FINANCIAL DEBT 3,777.6 (-11.1% vs. 4,249.8 as at 31 Dec. 2022) |

As illustrated in detail in the Annual Financial Report at 31 December 2022, starting from last year, Hera’s management decided to present the results by valuing the natural gas inventories according to a managerial criterion, in order to provide a representation consistent with a market context that shows significant and sudden changes in price compared to historical trends. During the first quarter of 2023, at the end of the winter season, and due to materialisation of the expected flows, the previous valuation mismatch was fully reversed, thus affecting the change for the period, but not the stock.

In the first quarter of 2023 Group’s Total Revenues reached 5,750.1 m€, up by 337.4 m€ (+6.2%). The growth was mainly driven by higher volumes in electricity – due to effective commercial action in traditional segments and awarding of safeguarded lots. In addition, incentivised activities for Energy Efficiency in residential buildings and Value-Added Services provided a significant boost to growth. Waste also made a positive contribution, mainly due to the recent acquisitions that entered the Group’s perimeter. These increases more than offset the negative impact of lower gas volumes, due to the mild temperatures recorded in the first quarter of 2023 and the savings in consumption that customers voluntarily implemented against higher prices.

Group’s Adjusted EBITDA amounted to 410.2 m€, a 35.1 m€ (+9.4%) increase compared to Q1 2022. Basically, the factors that drove such improvement were organic growth (+15 m€) and the continuous progress in circular economy activities (+14 m€), but also the contribution from the latest M&A operations (+6 m€), i.e., Macero Maceratese and ACR Reggiani.

| EBITDA (m€) | 1Q 2023 | 1Q 2022 | Change |

| Waste | 87.6 | 78.9 | +10.9% |

| Networks | 129.5 | 134.9 | -3.9% |

| Energy | 184.4 | 153.6 | +20.1% |

| Other Services | 8.7 | 7.8 | +11.5% |

| TOTAL | 410.2 | 375.1 | +9.4% |

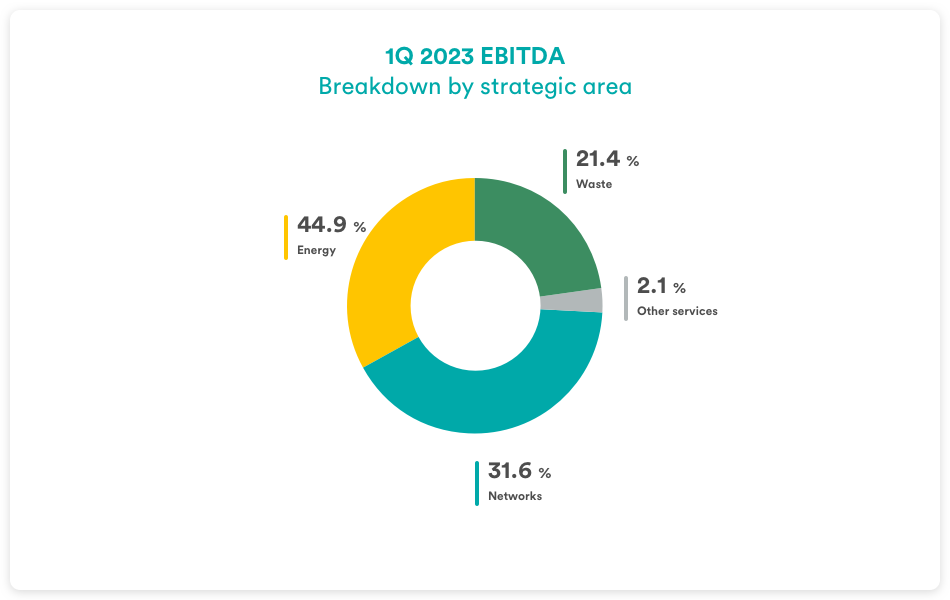

The EBITDA breakdown by strategic area shows that Energy had the highest weight in Q1 2023, showing the contribution from all major offer lines. On one hand, sales and trading activities recorded an increase of 16 m€ against stable unit margins, by leveraging on the increase in the number of new customers (+106 thousand), which also came from the last resort segments; such a strong customer expansion more than compensated for the negative impact on demand of mild winter temperatures. Moreover, the trading activity, which relied on the gas available in storage, optimised the management of modulation costs and imbalances, thus effectively neutralising the threats from the energy crisis. On the other hand, Energy Efficiency services continued to grow (+13 m€), benefitting from additional fiscal incentives set by the Italian government, while Value Added Services provided an incremental contribution of 2 m€, meeting the favour of customers that wished to optimise their energy consumption. The sale of gas stored in 2022 proves to have made a significant contribution: the accounting change in gas reserves is a positive 93 m€, against a negative 93 m€ at 2022YE.

A strong performance came also from Waste, which increased by 10.9% (+8.7 m€), despite it could not benefit from the full installed plant capacity, due to the revamping of two WTEs, of which only one returned to operation during this first quarter of 2023. Against a modest decline in the regulated activities of collection (-2.7 m€), the liberalised component showed a progress of 11.4 m€, reflecting the favourable combination of a 16.2% increase in treated waste with a slight price hike. Lastly, the contribution of M&A (+6.0 m€) remains a fundamental pillar, as a result of the consolidation of Macero Maceratese and ACR di Reggiani Albertino. The latter is a leading company in the remediation of industrial sites, with significant volumes in the treatment of special waste – whose acquisition of a 60% stake by Hera was concluded in early 2023.

The Network’s EBITDA showed a slight reduction of 5.4 m€ (-3.9%). Water was the only segment with a positive change (+0.1%), while the other businesses – district heating, gas and electricity distribution – were negatively impacted by the smaller number of connections, lower white certificates obtained, and higher costs incurred in the quarter. A WACC review of regulated activities is expected in 2024, based on the higher level of interest rates – which should rebalance the overall returns.

The Group EBIT also showed a positive performance, reaching 236.1 m€ (+6.7%), despite the 20.2 m€ rise in Depreciation and Amortisation (+13.1%), which mainly reflects new investments and the acquisition of new customers, as well as the wider consolidation perimeter.

The result of the area of financial management is negative for 44.4 m€, compared to a negative balance of 29.5 m€ in the first quarter of 2022. The increase was the result of higher costs related to new medium- to long-term credit lines negotiated in the past year to finance the expansion of net working capital caused by higher energy commodity prices. Hera’s average cost of debt is 2.96%, with a relatively small change from the 2.60% level recorded in 1Q 2022, considering the sharp rise in the cost of money that has taken place in the meantime.

The tax rate calculated on adjusted pre-tax profit stood at 26.8%, marking a decrease as a result of the opportunities the Group seized within those offered by the fiscal legislation. In addition to the tax efficiency implemented, the tax rate also benefits from the Group having no taxation on extra-profits, as in the case of energy companies, since the only generation activity takes place within the waste recovery processes at WTE plants.

Adjusted Net Profit post minorities in 1Q 2023 therefore reaches 128.2 m€, up 0.7% compared to the data of the same period of 2022.

ROE, which represents the return for shareholders (Adjusted Net Profit-to-Equity ratio), stands at 9.4%. Just as comforting is the level of ROI, at 8.6%.

The Net Financial Debt, which as at 31 December 2022 amounted to 4,249.8 m€, decreased to 3,777.6 m€ (-11.1%). The change of 472.2 m€ recorded during the quarter is mainly due to the sale of the gas reserves previously stored and the positive cash generation recorded during the quarter.

The Debt-to-EBITDA ratio is back at 2.84x, well below the 3.0x level that Hera prudentially set itself as maximum threshold not to exceed. This compares with the level of 3.28x posted at the end of 2022, or 2.9x when corrected for the value of gas in storage.