On 18 March 2019, Hera shares have been included into the FTSE MIB, the index made up of the 40 blue chips of Borsa Italiana, the Italian Equity Market. With this entry, Hera achieves a goal that has long guided the efforts of the Company’s Investor Relations.

We talk about that to Mr. Jens Hansen, head of Hera’s IR since its IPO.

Is the entry into the FTSE MIB an important objective?

Together with all the colleagues, the IR team has worked for so long to win a place in the blue chips arena on the Italian equity market. We deserved that entry for the sound financials achieved over time, through a continuous growth in the last 16 years, a period in which we succeeded in navigating economic cycles and operating scenarios with an effective and reactive attitude. Those results translated into high market capitalisation, sometimes even higher than that of companies already included in the Index.

Then, why Hera has been included into the FTSE MIB just now?

Full market cap, calculated by multiplying the stock price by the number of outstanding shares, is not the screening criteria adopted when periodically reviewing the FTSE MIB constituents. Borsa Italiana rather applies a formula based on two factors: the free-float market cap and the value of the volumes traded over the six-month period preceding the date for the review. It represents the so-called Liquidity and Capitalization Index (LCI) that ranks the companies eligible for entry or exit from the Index.

This time, how could you enter the Index?

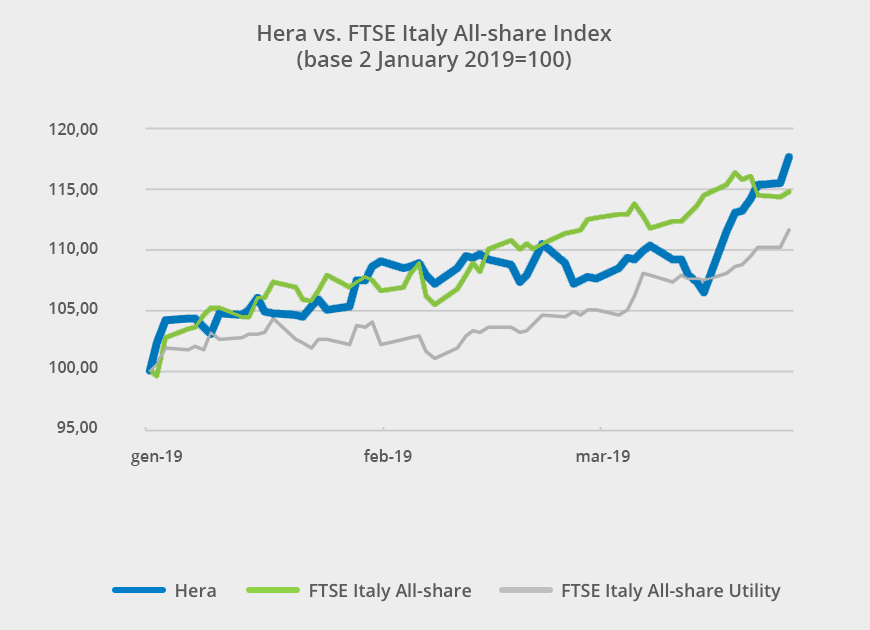

Several times the Company was at the top of the reserve list, but there was no extraordinary event paving the way to inclusion. This time, Hera ranked 35th, an LCI position therefore exceeding that of five Index components. In the first week of December 2018, the road show organised in Australia has aroused lively interest in investors met. Moreover, the Business Plan presentation in early January fuelled the stock price, with volumes increasing by 52% in the first two months of 2019, compared to the average traded volumes of 2018.

What happens with the entry announcement?

The IR team had modelled the LCI formula and long monitored the evolution of the ranking; therefore, it was no surprise. In advance, since we expected the event, we prepared some communication tools aimed to spread the knowledge about Hera equity story, reaching portfolio managers never met during past road shows, who can consider the Company for the inclusion in their portfolios following its entry in the FTSE MIB.

What are the potential benefits of the Index membership?

For sure, once included in the Index, it looks much more likely that new investors, managing large portfolios – especially index funds – will put Hera’s shares under their radar and then they buy. That should favour increased volumes and liquidity. A portfolio manager evaluating a stock investment always considers how many days it would take to sell holdings position, should the fund experience outflows. An improvement in the liquidity profile is a crucial point in investment decisions. A FTSE MIB stock enjoys better visibility at the eyes of both passive investors, tracking the Index, and active investors, looking for alfa stories. These counterparts follow structured investment process with strict criteria, firstly on ESG (Environment, Social e Governance) issues: that poses a demanding challenge to Hera, while it represents an opportunity, at the same time.

When will these effects be visible?

Since the date of the announcement of Hera’s entry into the Index, volumes increase exceeded 200% vs. average volumes recorded in 2018. Moreover, we might broaden the analyst coverage, including PanEuropean brokers focused on the blue chips of each market: the combination of the effects deriving from such changes could improve stock valuation, with beneficial impacts on price performance.

Hera stock price is gradually closing the gap with the average target price of the analyst coverage at the end of 2018. In the meantime, the consensus did not substantially change, as it moved from 3.28 euro at the beginning of the year to the current level of 3.36 euro.

The overwhelming majority of analysts has buying recommendations, with only one neutral rating and zero selling suggestion. Since analysts have maintained their buying recommendations, even after the strong pick up in Hera’s stock price, it looks like they will update their valuations after the release of 2018 earnings, and then re-consider even their respective ratings accordingly.

| Broker | Rating | Target price (€) |

| Banca Akros | Buy | 3.4 |

| Banca IMI | Buy | 3.8 |

| Equita Sim | Buy | 3.15 |

| Fidentiis | Buy | 3.3 |

| Intermonte | Outperform | 3.3 |

| Kepler Cheuvreux | Buy | 3.5 |

| MainFirst | Neutral | 3.05 |

| Mediobanca | Outperform | 3.4 |

| Average | 3.4 |