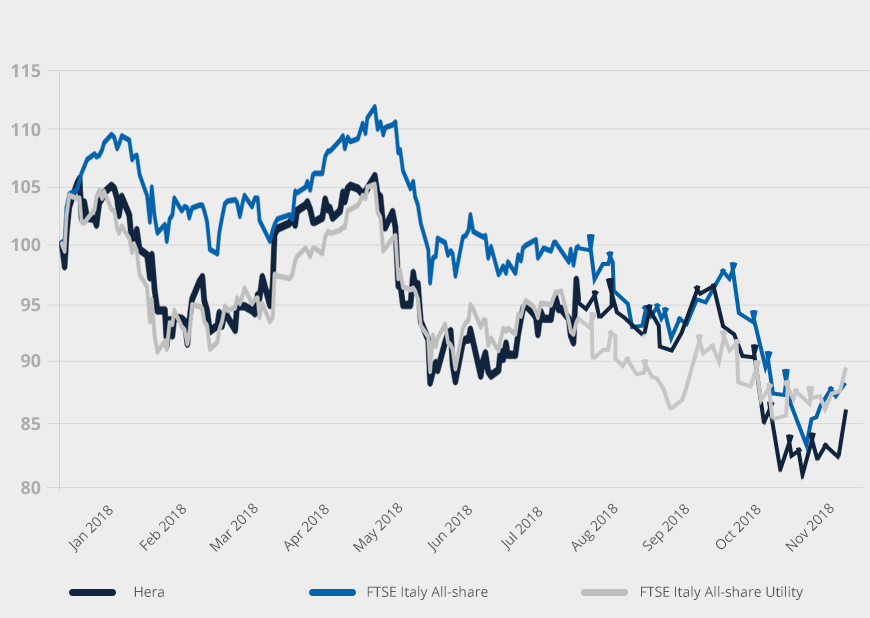

Hera vs. FTSE Italy All-share Index (base 2 January 2018=100)

Hera trades at a huge discount to the average target price of the brokers that cover the stock, which is 3.32 euro; a value that remained substantially unchanged compared to that of 28 July 2018, date of release of half-year results, when the consensus target price was 3.34 euro. The overwhelming majority of analysts rating consists of buying recommendations, with only one neutral rating and zero selling suggestion.

| Broker | Rating | Target Price (€) |

| Banca Akros | Buy | 3.30 |

| Banca IMI | Buy | 3.60 |

| Equita Sim | Buy | 3.50 |

| Fidentiis | Buy | 3.30 |

| Intermonte | Outperform | 3.20 |

| Kepler Cheuvreux | Buy | 3.40 |

| MainFirst | Neutral | 3.05 |

| Mediobanca | Outperform | 3.20 |

| Average | 3.32 |

That positive view of Company-specific factors did not prevent the stock from suffering from the uncertainty about the 2019 Budget Law of the new Government and the effects of the rise in the Bund-BTP spread. Those effects are particularly significant in the utility sector, provided the negative correlation of the sector’s stock prices with the level of interest rates. Companies, like Hera, whose business is concentrated in Italy, resulted in being the most penalised by the investors’ risk aversion, especially in the last few weeks.

In this scenario, Hera has continued to pursue its Investor Relations programme regularly, raising a great deal of interest. The fruitful participation to the Italian Infrastructure Day, which took place at the Italian Stock Exchange on 6 September 2018, is evidence of this. At that event, investors stated their agreement and appreciation for the following Group’s strengths:

- Hera is an efficient Company, both in investing and in serving its customers.

- The Company achieved a leadership on competitive markets that in the coming years will ensure the strength to play a key role in aggregating small local operators, as they make few investments with limited returns, due to their inefficiency. That opportunity will materialise in both liberalised and regulated markets, as the tenders for gas distribution and urban waste collection are now approaching.

- Hera’s infrastructure boasts a high level of reliability and is in line with the best international standards, due to the technological innovation and the implementation of the “Circular Economy” model.

- The corporate governance is stable and structured to ensure the full development of Hera’s business model and the achievement of the EBITDA growth target included in the Business Plan. A target that has been already 42% achieved as of 30 September 2018, i.e. in 35% of the entire five-year period covered by the Plan.

- The Italian regulation, with a WACC review every two years, provides for the incorporation into the tariff model of any change in interest rates and spreads.

In summary, investors confirmed to recognise:

- The sustainability of Hera’s long-term strategy

- The value of its assets, both tangibles (networks) and intangibles (innovation, competitiveness and customer base)

- Its well-balanced business model, able to generate profitable results and healthy cash flows that will make it possible to see the challenges in the future outside scenario as additional growth opportunities.

Recognition of Hera’s commitment to ESG issues

Hera was included by Thomson Reuters in the Top 100 Global Energy Leaders

It is no longer enough to analyse the balance sheet of a Company to judge its strength, amidst deep changes in regulation, technology and environment mandates, with risks that may suddenly arise either in the financial markets or in the supply chain.

In accordance with this consideration, which is especially true in the case of the energy sector, Thomson Reuters has created a methodology that represents a new valuation metric to identify the global sector Leaders. Through a holistic approach, which obviously includes the traditional financial metrics used by investors, has thoroughly assessed factors such as supply chain risks, pending litigation, innovation and environmental governance.

The energy companies that entered the top 100 ranking – including Hera – should be considered, quoting Thomson Reuters, “Renaissance Organizations” that best succeed in the complex regulatory and business scenario as decathletes, as they operate with the agility and acumen to stay one step ahead of constant changes.

The Thomson Reuters Diversity and Inclusion ranking recognises Hera’s efforts in this direction

With a score of 73.5 points out of 100, Hera resulted in ranking first among global multi-utilities in the Thomson Reuter Diversity and Inclusion Index, which is a benchmark for investors taking into considerations these criteria when building their portfolios.

The index provides a ranking for the performance of some 7,000 companies L’indice classifica le performance di 7.000 società sulla base di fattori relativi a diversità, inclusione, sviluppo delle persone e controversie legate all’esposizione sui media.

Regardless of the industry, Hera moreover resulted in ranking second among Italian companies and 22nd in the world.