Hera outperforms both in bull and bear markets

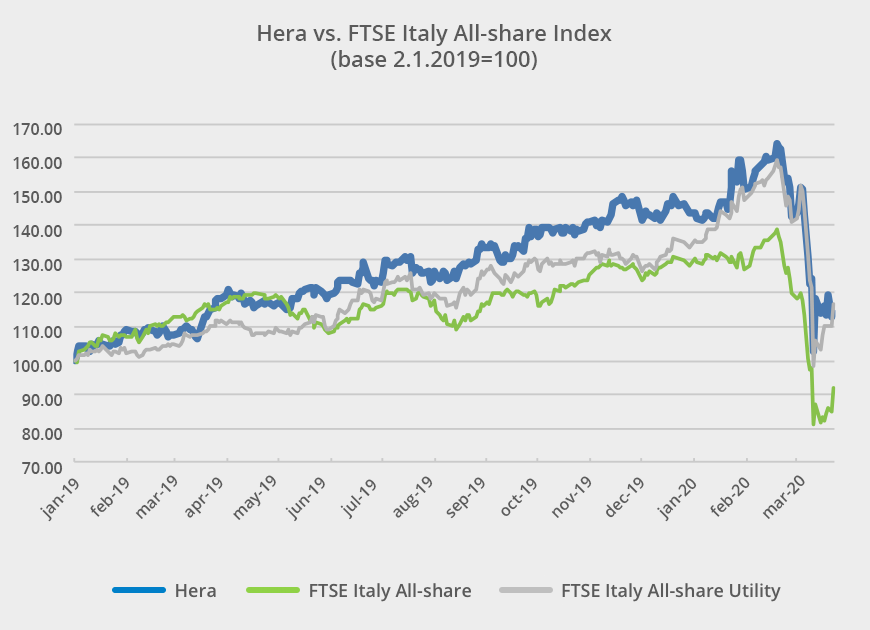

Over the period from 2018 year-end to 19 February 2020, Hera’s share price surged (+67%), overperforming both the industry index – which grew by 61% – and, to an even greater extent, the Italian Blue Chips index, which in the same period increased by 39%. The violent impact of the Covid-19 pandemic outbreak, which triggered a generalised collapse of the stock market, caused a rapid and deep correction for Hera’s shares, even if to a lesser extent compared to the other Italian utilities and the FTSE MIB.

In the two opposite trends – at first during the long uptrend period and later on, with the sudden crash – Hera has outperformed. That proves how its equity story is capable, through a clear growth strategy, to capture the expectations of investors chasing the “alfa”. On the other hand, Hera proved it can maintain all the benefits of a very low “beta” – which stands at around the half of that for the Italian stock market – boasting all the features of a defensive stock in a bear market.

One year ago, on 18 March 2019, Hera’s share entered the FTSE MIB index. This resulted in a deep change in the nature of the institutional shareholding base, with the exit of PIR funds, focused on smaller capitalisations, and by contrast with the entry of new institutional investors, included those following passive index-benchmarking strategies.

The benefits, on top of higher liquidity, were significant also in terms of visibility. As member of the FTSE MIB, Hera therefore now enjoys an exposure to an excellent target audience, which includes the largest and most prestigious asset managers at global level.

Aware of this opportunity, Hera has multiplied its efforts in terms of transparency, enriching contents and communications tools, while also enhancing the number and profile of meeting initiatives with the financial community. Those efforts had an effective response in external awards and in a successful Investor Relations program.

Before the interruption of the last part of the roadshow of presentation of the Business Plan to 2023, due to the Covid-19 restrictions, in the first weeks of the year Hera’s senior management met in 10 different financial hubs with a total of 75 investors, out of the 96 scheduled in the agenda, between Europe and North America. Those institutions have assets under management for more than 3.6 billion dollars, an amount that is almost double than that managed by our audience one year ago.

From the beginning of 2019 to date, in total we met 113 institutional investors, with a material impact also in the composition of our shareholders register, where the number of institutions increased by 14% compared to beginning 2018.

Focus on targetting long-term investors that include sustainability criteria in the construction of their portfolio worked alongside with an intense activity to obtain the ESG ratings, through the participation to different assessments, with results indicating the progresses that Hera has achieved.

With a score moving from 21 in 2018, to 68 in 2019, Hera was the Biggest Improver of 2019 in the Dow Jones Sustainability World Index, with an outperformance in particular in the Environment area. Also the score of Sustainalytics increased from 75 to 79, placing the Company in the Outperformer category. Level B and level A were also confirmed respectively for CDP and MSCI ratings, both of great significance to investors.

Top-class awards confirm that our commitment is focused in the right direction. Institutional Investor, following a polling of 1,600 institutional professionals, awarded Hera with the Best Investor Relations Team prize and honoured the undersigned with the Best IR Professional prize, both in the Energy industry. Furthermore, in the Italian Webranking of Comprend, we reached the third position, confirming us – as in recent years – among the top-three Italian companies in online communications. Lastly, we received the special award Oscar di Bilancio per la Comunicazione Finanziaria, an Annual Report award in the Financial Communication category, organised by Ferpi in collaboration with Borsa Italiana and Bocconi University.

We also enriched our tools to interact with the market, creating an in-depth Company Presentation that we released on the occasion of our entrance in the FTSE MIB, and completing a few days ago the new version of the Sensitivity Game – to which we are dedicating an article in this newsletter.

Despite the introduction of the MIFID II, in the beginning of 2018, and the following consolidation of the industry were suggesting a substantial decrease in the breath of coverages, all the analysts covering Hera continued to follow our stock, even upgrading their estimates and valuations over time.

Today the consensus target price, despite the crisis related to Coronavirus, is 4.08 euro, 24% higher compared to the data at the end of 2018, which was equal to 3.28 euro.

Considering the current price levels, analysts indicate target prices highlighting significant room for potential appreciation.

| Broker | Rating | Target Price (€) |

| Banca Akros | Buy | 4.10 |

| Banca IMI | Buy | 4.70 |

| Equita Sim | Buy | 3.80 |

| Fidentiis | Hold | 4.20 |

| Intermonte | Outperform | 4.20 |

| Kepler Cheuvreux | Hold | 3.50 |

| MainFirst | Neutral | 4.03 |

| Mediobanca | Neutral | 4.10 |

| Average | 4.08 |