Dear Shareholders,

The new Business Plan for the 2018-2022 period starts with a convincing performance already in its first year; our forecast for 2018 EBITDA is 1,020 m€, a growth of 35 €m compared to 2017. Over the last two years, Hera has therefore achieved an EBITDA increase exceeding by 16 m€ that included in the rolling Plan to 2021. Actually, we fully delivered the target of cumulated growth of 210 m€ that we had announced in 2013 for the following five-year period.

Limited risk profile and linear growth through the cycle: two strengths providing visibility to shareholder remuneration

Noteworthy, the scenario we assumed in 2013 did not include some challenges we had to address on the way: delays in gas tenders, a sizeable cut in WACC and lower incentives on renewables. Taken together, these three factors have withdrawn approximately 56 m€ to cumulated EBITDA.

Having anyhow achieved a 210 m€ growth over the 2013-2018 period, we have proven our ability to manage and execute the Business Plan in a flexible manner, by overcoming critical challenges in the external environment and seizing new opportunities that may arise along the way.

Given such a track record, in the new Plan to 2022 we have chosen to confirm the strategic structure based on consolidated pillars that over the last few years allowed Hera to create significant value, in a regular and resilient way, notwithstanding the difficulties arising from the outside environment.

First of all, we will pursue a sound balance between regulated and liberalised businesses. We mean to continue to have a portfolio with a limited risk profile, which allows for operating and commercial synergies; given our diversification in the Networks business, we will also be able to meet growing customers request for multi-utility offers.

The second pillar we will leverage is organic growth, i.e. Hera’s real engine for development, which has driven a five-fold increase of EBITDA over time.

We will also continue to focus on M&A deals, selecting investments that offer synergies and supplement our current business portfolio: we will mostly target multi-utilities, but we will also consider companies involved in energy sales and in waste treatment.

In the Plan’s period, we will invest 3.12 b€, with an increase of 260 m€ compared to the previous Plan: around 1.14 b€ will be focused on development, while 1.98 b€ will be aimed to the maintenance of current assets. Around 76% of capital we be allocated to regulated businesses, in order to support a new expansion cycle in our infrastructures, following the one that took place in the 2002-2012 period, which was mainly dedicated to update the original asset base.

The strong cash generation expected in the 2018-2022 five-year period will allow us to fund the robust capex plan, without affcting the financial strength that Hera can presently boast. Despite the demanding investments planned, the Debt-to-EBITDA ratio will be still 2.9x, i.e. at the same level it was forecast to be in the last year of the previous Plan. Moreover, by staying below the 3.0x threshold, Hera’s debt will continue to be considered sustainable by rating agencies.

We expect an EBITDA increase of 200 m€ between 2017 and 2022, up to 1,185 m€ in 2022 from 985 m€ in 2017.

All in all, in the five-year period, around 50% of the EBITDA increase should be driven by organic growth; an overall contribution of 98 m€ will mainly derive from returns of planned development projects, higher market shares in the Energy business and increased volumes in treated waste, in addition to higher WACC and financial bonuses in regulated activities. We also expect that the additional contribution from the activities that will enter our consolidation scope through gas tenders will amount to 32 m€, while we estimate a contribution of approximately 80 m€ from M&A deals, as Hera will be able to play an aggregating role on the Italian market that is still very fragmented.

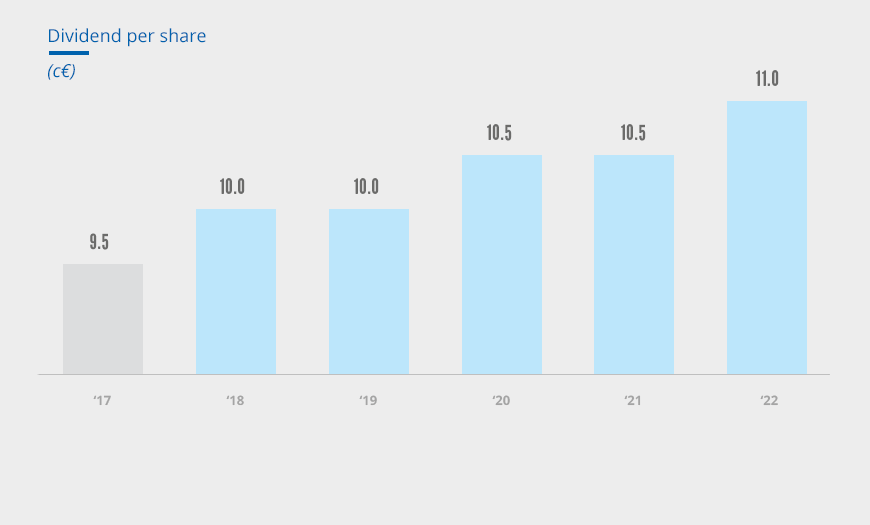

The dividend policy envisages a 16% increase of DPS

Lastly, we confirm our commitment towards our shareholders. We want them to invest in Hera’s shares being aware of returns we expect from our investment plan and having a clear picture of the earnings distribution policy we will stick to. We expect to be able to increase the dividend per share over time, reaching 11 c€ for the 2022 fiscal year, compared to 9.5 c€ for the 2017 fiscal year, with an increase of 0.5 c€ every two years.

In light of healthy fundamentals, Hera has always distributed unchanged or growing dividends per share over time. The new Plan has a proven structure, consistent with that of the previous Plan; moreover, it offers attractive returns from 3.14 b€ of investments planned. Good premises, therefore, for visible shareholder remuneration.